William Koo Ichioka, a 30-year-old New York resident faces a $36.4 million penalty in federal court for a crypto and forex scam that promised big returns but delivered deceit.

Judge Vince Chhabria of the United States District Court for the Northern District of California issued the verdict, ordering Ichioka to pay $31 million as restitution to the victims and $5 million in civil penalties, according to the Commodity Futures Trading Commission (CFTC).

The CFTC Pressed Charges Against Ichioka in Mid-2023

The CFTC began a civil enforcement action against Ichioka in June 2023. He was accused of scamming unwary investors in a scheme that started in 2018. The allegation included fraudulent solicitation and theft of more than $21 million from over 100 commodity pool members. Ichioka conceded the allegations and consented to the order of judgment.

According to the federal judge’s order, Ichioka combined the investor funds with his own and created false financial statements that exaggerated the worth of the investments. He deceived investors into believing his commodity pool would yield 10% returns every 30 working days. In reality, no returns were made to investors. Instead, he spent the money on his personal expenses.

“Although Ichioka invested some funds in forex and digital asset commodities, he commingled participant money with his own funds and used participant funds for his own personal expenses, including, among other things, rent for his personal residence, jewelry, including watches, and luxury vehicles,” the CFTC said in the press release.

Prosecution and Sentencing

Besides the CFTC’s action, the US Attorney’s Office for the Northern District of California and The Securities and Exchange Commission (SEC) also filed criminal charges against Ichioka.

On June 22, 2023, he was charged with commodity, securities, and wire fraud and submitting false tax returns. He pleaded guilty on the same day and was sentenced to four years in jail and five years of supervised release. In addition, he was fined $5 million and was ordered to pay restitution of $31 million.

The sentencing concluded multiple judicial proceedings against Ichioka as he was found guilty of participating in crypto fraud scams that victimized many investors over several years.

Concerns Over Cryptocurrency Fraud Persist

Despite the remarkable expansion and development of the digital asset ecosystem in recent years, the presence of frauds, hacks, and scams continues to be a major concern for global investors.

According to FBI data, losses from cryptocurrency fraud increased by 45% to $5.6 billion in 2023. Surprisingly, 71% of these claimed losses resulted from investment scams like the one Ichioka was involved in. Such events highlight the necessity for enhanced security measures and public awareness campaigns regarding the proper use and functioning of cryptocurrencies.

The CFTC issued a warning to investors about the hazards of investment fraud in forex and crypto markets. The Agency recommended the public check any individual or company’s CFTC registry before investing. If an entity is not registered, investors are advised to refrain from investing funds.

The agency suggests the public report any suspicious activity or possible violations of commodity trading regulations. Whistleblower payments are available from the CFTC’s Customer Protection Fund, financed by monetary penalties paid by offenders.

“Whistleblowers may be eligible to receive between 10 and 30 percent of the monetary sanctions collected, paid from the Customer Protection Fund financed through monetary sanctions paid to the CFTC by violators of the CEA,” the CFTC says.

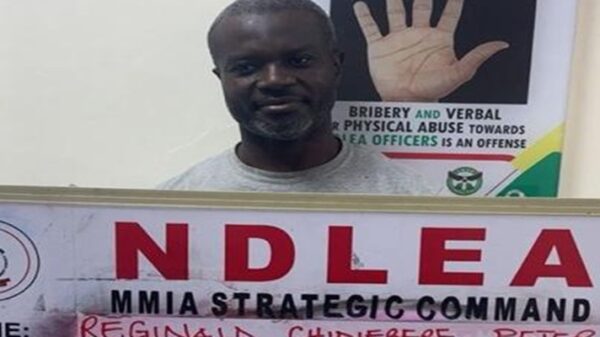

![]()