Federal Inland Revenue Service (FIRS) has enlisted the support of the Economic and Financial Crimes Commission (EFCC) to intensify enforcement of voluntary tax compliance across Nigeria.

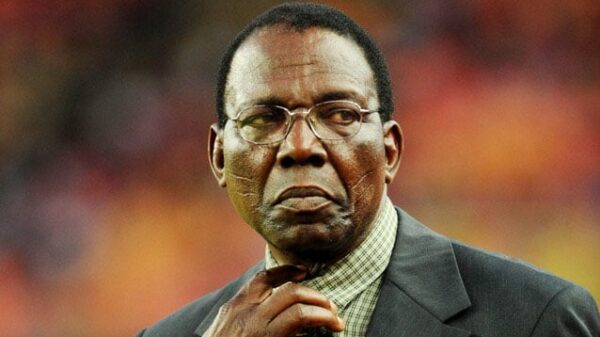

During a courtesy visit to the EFCC headquarters in Abuja, FIRS Executive Chairman Dr. Zacch Adedeji emphasized the importance of inter-agency cooperation in building trust and sustaining financial stability.

He noted, “We cannot pursue 200 million Nigerians individually to do the right thing, but we want to put a system in place that will aid compliance.”

Adedeji thanked the EFCC for its continued support and called for deeper collaboration, especially in helping the public understand the consequences of tax violations.

A recent Court of Appeal ruling affirmed EFCC’s authority to investigate tax fraud, bolstering its role in financial crime prevention.

Meanwhile, the newly signed Tax Acts—set to take effect in January 2026—will transform FIRS into the Nigerian Revenue Service, signaling a broader mandate and structural reform.

President Bola Tinubu recently announced that Nigeria had met its revenue target for the year by August, collecting approximately ₦20 trillion—primarily from non-oil sources.

Adedeji credited this success to preventive strategies and agency partnerships, saying, “The achievement was a collective effort, not one by FIRS alone.”

EFCC Chairman Ola Olukoyede reaffirmed the commission’s dedication to the partnership, stating, “Collaboration is key. When they see EFCC beside FIRS, that will send a signal to the public that it is no longer business as usual.”

He clarified that while EFCC does not assess tax liabilities, it plays a critical role in investigating non-compliance and supporting enforcement.

Both agencies pledged to reinforce preventive measures and promote voluntary compliance as foundational pillars of Nigeria’s evolving tax system.

Adedeji concluded by stressing that visible public benefits from tax revenue are the strongest incentive for compliance: “The main advertisement of voluntary compliance is when people begin to see what we use the money we collect for.”

![]()