The harassment and defamation of borrowers from digital lending companies, popularly known as loan apps, is far from over despite the recent regulatory moves by the Federal Competition and Consumer Protection Commission (FCCPC).

Ravenewsonline gathered that some of the loan apps registered by the FCCPC continue to defame their customers through the usual practice of sending messages to contacts of their debtors. This also contradicts a recent Google policy forbidding loan apps from accessing their customers’ photos and contacts.

While Google is collaborating with the FCCPC to ensure that loan apps in Nigeria adhere to ethical standards, apps currently listed on the Google Play Store are still among the culprits according to our findings.

Threat Messages To Customers

A customer who shared his experience with one of the loan app providers listed on the Play Store, fearing that he might be defamed at any time, showed message evidence from 9jcash to Nairametrics which read:

“You will regret collecting this loan now.”

Another registered loan app provider, NowNowmoney, sent the following message to one of its customers earlier this week:

“Our agents have been calling and yet payment has not been made. Make a transfer now to the Wema Bank account provided and save your reputation. Failure to make payment now might ruin your reputation and respect. Do the right thing now and clear your debt.”

Steady Cash another provider, which is also on the Google Play Store and registered by the FCCPC, sent this to one of its customers:

“It is either you make your payment now or face the consequences because we are sick and tired of your lies, your BVN will be exposed, and your account placed on auto debit. Your contacts will be informed of your shameful exhibition…Please be warned.”

In another more disturbing development, a customer of Mint Credit lamented how his entire family is currently being defamed by the loan app provider for a loan he took by sending messages to all his contacts, sighted by Nairametrics, which read;

“Beware of the family of…. (The debtor’s family name is mentioned), mother, father, and sister are chronic criminals and fraudsters. They dupe a company with some money, and they are refusing to pay. He has been declared wanted. If you know him, tell him to pay his debt.”

All efforts by Newsonspot to get comments from the operators of NowNowmoney, 9jacash, and Steady Cash proved abortive as emails sent to them were not replied to as of the time of filing this report.

Meanwhile, checks revealed that Mint Credit has been removed from the Google Play Store and might not be among the registered loan apps by the FCCPC.

Data Protection Concern

The activities of the loan app providers have also been found to constitute a breach of the country’s data protection law. According to the National Commissioner of the Nigeria Data Protection Commission (NDPC), Dr. Vincent Olatunji, many digital lenders in the country have been reported for breaches and are currently under investigation.

Section 35 of the Nigeria Data Protection Act, which was recently signed into law by President TInubu, states that a data subject (individuals whose data are being exploited) has the right to obtain from a data controller, without constraint or unreasonable delay confirmation as to whether or not the data controller, or a data processor operating on its behalf, is storing or otherwise processing personal data relating to the data subject, and where that is the case the subject has the right to know.

The purposes of the processing; the categories of personal data concerned; the recipients or categories of recipients to whom the personal data have been or will be disclosed in particular recipients in third countries or international organizations…”

None of these is being complied with by the loan app providers as of now.

FCCPC’s Interim Registration Framework

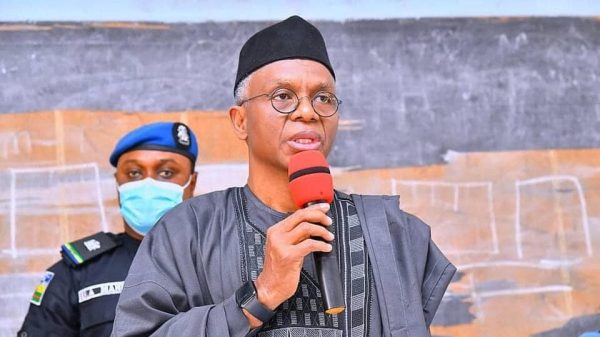

According to the Chief Executive Officer of the FCCPC, Babatunde Irukera, the continuous violation of people’s privacy and unethical recovery practices led to the introduction of an interim registration framework for digital lenders in partnership with the Independent Corrupt Practices and Other Related Offences Commission (ICPC), Central Bank of Nigeria (CBN), Economic and Financial Crimes Commission (EFCC), and the Nigerian Communications Commission (NCC).

At the close of the registration on March 27, 2023, the FCCPC released a list of 173 digital lending companies that had been registered. The companies were said to have provided information regarding their interest rates, the type of information they access from their customers, and sources of their money, among others.

In June, the Commission announced its intention to reopen the registration to allow new digital lenders that just came up to be registered. And as of June 26, the total number of registered digital lenders in the country had increased to 180.

The FCCPC CEO, however, noted that registration does not mean that all the registered companies are law-abiding, but it will significantly reduce how they violate the law. According to him, with the information provided by the registered companies, the Commission can easily trace them and hold them accountable if they violate any law.

![]()