CANAL+ has made a mandatory offer to acquire all the issued shares of the MultiChoice Group it doesn’t already own for $1.9 billion.

CANAL+ was required to make the offer after acquiring 35 percent ownership of the company, now offering $6.70 per share, exceeding the regulatory minimum price of $5.63.

The two companies have entered an agreement for the mandatory offer, and MultiChoice shareholders will gain significant value for their shares, constituting a 66.66 percent premium to the closing price of $$4.02 on February 1, the last trading day prior to the delivery of CANAL+’s non-binding indicative offer.

The offer is conditional on customary regulatory conditions and will comply with all other relevant regulatory requirements.

CANAL+’s ambition is to build a global entertainment leader with Africa at its heart that will support the commercial development of Africa’s sporting and cultural industries and bring authentic African stories to global audiences.

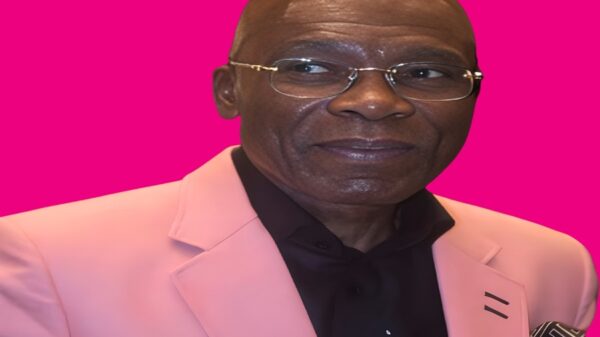

“Following constructive engagement with MultiChoice, we are pleased to have issued a joint firm intention announcement to make an offer today, representing a significant premium for the shareholders of MultiChoice,” said Maxime Saada, chairman and CEO of CANAL+ Group.

“CANAL+ is confident in making this offer—at a level which far exceeds the minimum required by regulation—due to the incredible future we believe that CANAL+ and MultiChoice can build together.

“Through combining our companies, we will be well positioned to invest even more in local productions and sports content, supporting the world-leading and vibrant creative ecosystem on the African continent and all over the world, and producing even more high-quality and compelling local stories.

“The complementary geographies, considerable scale and strengthened capabilities achieved by the combination of these two great companies will ensure that Africa can tell her own stories on her own terms both locally and globally.

“We are excited about these opportunities, which will be supported by further investment in technology, including the continued offering of a leading satellite service and rolling out more innovative streaming products.”

![]()