Federal Competition and Consumer Protection Commission (FCCPC) has commenced enforcement actions against Digital Money Lending (DML) operators that failed to regularise their operations under the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025 (DEON Regulations).

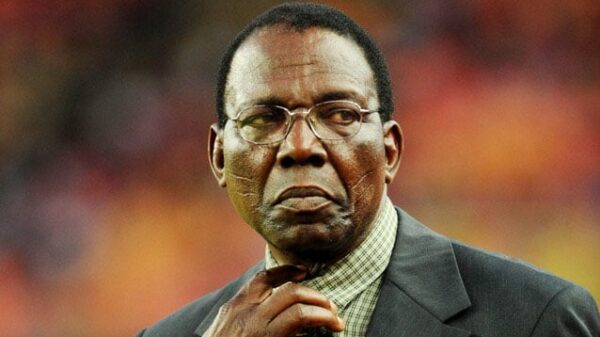

FCCPC

The commission withdrew the conditionally approved status of non-compliant DML firms and removed them from its official register of approved digital lenders, effective immediately after the January 5 compliance deadline.

FCCPC Executive Vice Chairman and Chief Executive Officer, Mr Tunji Bello, announced the measures on Wednesday, emphasising their role in upholding regulatory standards and ensuring certainty in Nigeria’s digital lending sector.

Mr Bello stated that the compliance window provided under the DEON Regulations, which took effect on July 21, 2025, had closed, paving the way for fair, orderly and due process-driven enforcement.

He noted that the actions target persistent issues such as exploitative loan recovery tactics, data privacy breaches, harassment of borrowers and anti-competitive practices that have plagued the sector.

The DEON Regulations, issued on September 3, 2025, under the Federal Competition and Consumer Protection Act 2018, mandate all non-bank digital lenders to register, adhere to fair interest rates, ethical debt recovery and robust data protection measures.

Non-compliance now attracts severe penalties, including fines up to N100 million or one per cent of annual turnover, operational restrictions, app store delistings and potential director disqualifications for up to five years.

As of late 2025, the FCCPC had granted full approval to 438 digital lending companies, with recent data indicating over 521 firms now under regulatory scrutiny post-deadline.

The commission’s phased crackdown involves collaboration with the Central Bank of Nigeria, Google and Apple for account freezes and global app removals targeting unregistered platforms.

Industry watchers described the enforcement as a landmark move to sanitise Nigeria’s fast-expanding digital credit market, which has seen rising borrower complaints despite earlier 2022 interim guidelines.

The FCCPC reiterated its commitment to balancing innovation with consumer protection, urging affected operators to swiftly meet requirements for reinstatement.

![]()