MTN Group announced Tuesday that the board of IHS Towers has unanimously accepted its offer of US$8.50 per share in a transformative transaction that will elevate MTN’s ownership to 100% of the tower company, following IHS’s divestment of Latin American assets on February 11 and 17, 2026.

MTN Group / IHS Towers

The deal, valuing IHS at an enterprise value of approximately $6.2 billion, requires shareholder approval, regulatory nods, and NYSE delisting, with closure eyed for later in 2026.

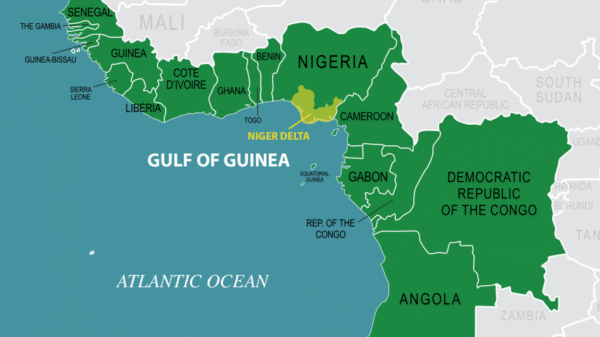

IHS operates nearly 29,000 high-quality towers across Africa, serving mobile operators in five core MTN markets including Nigeria, Côte d’Ivoire, Cameroon, Zambia, and South Africa.

MTN, holding a 24.7% stake, will acquire the rest for about US$2.2 billion via cash merger, funded by US$1.1 billion from IHS’s balance sheet, MTN liquidity, and debt—no new equity issuance needed.

This reintegration allows MTN to internalise current tower margins paid to IHS, harness third-party revenues, ensure cost predictability, and tap long-term value in its infrastructure.

The offer delivers a 9.7% premium over IHS’s 30-day volume-weighted average NYSE price as of February 4, 2026—the last trading day before MTN’s cautionary note—and strong shareholder backing, with long-term investor Wendel pledging votes in favour, securing over 40% toward the two-thirds threshold alongside MTN’s shares. The transaction promises accretion to MTN’s net income and cash flow despite modest leverage uptick.

MTN Group President and CEO Ralph Mupita hailed the move: “This proposed transaction is a pivotal step in further strengthening MTN Group’s strategic and financial position for a future where digital infrastructure will become ever more essential to Africa’s growth and development.”

He added: “This transaction gives us a unique opportunity to buy back our towers and strengthen our ability to be partners for progress to the nation states in which we operate.

“For IHS customers and partners across the continent, we commit to continuing high standards of service and the right governance of what is the largest standalone and integrated tower company in Africa, enabled by the excellent people within IHS.”

IHS Chairman and CEO Sam Dawish (also referenced as Sam Darwish in reports) affirmed: “The proposed transaction deepens our long-standing partnership with MTN as it combines Africa’s largest mobile network operator with one of its largest digital infrastructure platforms and underscores the strong connection between IHS Towers and the African continent.”

He noted it offers shareholders certainty and immediate value realisation amid market volatility.

The pact follows exploratory talks flagged on February 5, 2026, underscoring MTN’s disciplined capital strategy while bolstering Africa’s telecom backbone.

Ravenewsonline anticipates enhanced digital infrastructure synergies continent-wide.

![]()