According to the Fintech Times, women have long been financially excluded when it comes to traditional forms of credit rating and decision making.

Research has also revealed that women face barriers in forming the kinds of relationships that are critical for success because of bias from their male counterparts.

In situations like this, women’s outlier status is then taken as evidence that they are not cut out for the team or the industry in the case of business owners.

To bridge this gap, there’s an increasing need to provide a thriving environment for women-led businesses through unlimited access to funding, easy banking and mentorship, which is the thrust of Sara by Wema – a female proposition by Wema Bank – since it launched three years ago.

Many women around the world have shared their experiences and how women communities have been instrumental in encouraging them to be the best version of themselves. They have also realised that women are stronger when they come together.

In celebration of the 2022 edition of International Women’s Day, the Sara Website was unveiled as a platform where women in different parts of the world can connect seamlessly.

The website has an exciting chatroom where women can meet and discuss issues in real-time, is geared towards ensuring that its customers have an opportunity to network from the comfort of their homes or place of business.

There are many reasons why networking and women’s participation in various business and technical communities like Sara by Wema is an important and right step towards personal and professional growth. Within the community, every woman can find a safe and comfortable place where she can share her work problems, receive help, and support from other members.

The Sara website will further help amplify the voices of women and also serve to correct popular sexist beliefs by proving that women can be women’s biggest supporters. The platform will help connect women around the world to new connections and opportunities that will position them for personal and professional growth.

Over the course of its existence, the female-focused proposition by Wema Bank has organized bespoke training tailored to meet the needs of business owners. Some of which include business planning and development, taxations, savings and investments.

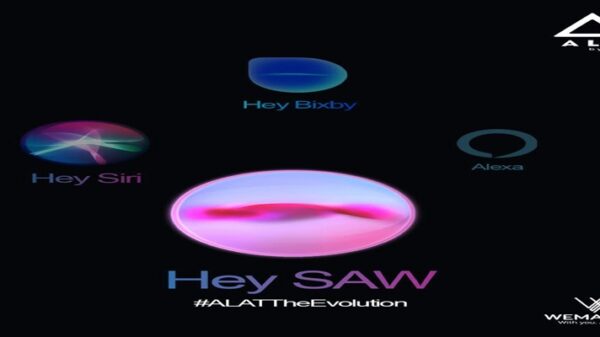

With Sara by Wema, the bank is also able to provide financial advisory services, information on recent business trends, regulations, tips for growing a successful business and mentorship opportunities for young entrepreneurs.

Also notable is the 9% interest rate SME Loan available to existing and new female customers. With up to ₦1 million and no collateral, no guarantor required, the SME loan product has been specially modified to help women within the Nigerian business landscape actualize their financial goals with reduced hassle. The loan is given to selected female beneficiaries to help offset immediate business needs and to restock on finished goods or business products.

Also, in partnership with AIICO Insurance Plc, Sara by Wema provides a health scheme plan for women. With as low as ₦1,600 monthly (₦16,000, annually) women in Nigeria can enjoy a series of healthcare services ranging from gynaecology to paediatrics support.

In the last 3 years, the has also partnered with some beauty stores, restaurants and health establishments to provide deals and discounts to women in the Sara community.

With the Sara by Wema website, the bank plans to make a lasting impact on millions of women, while strengthening their sense of community.

![]()