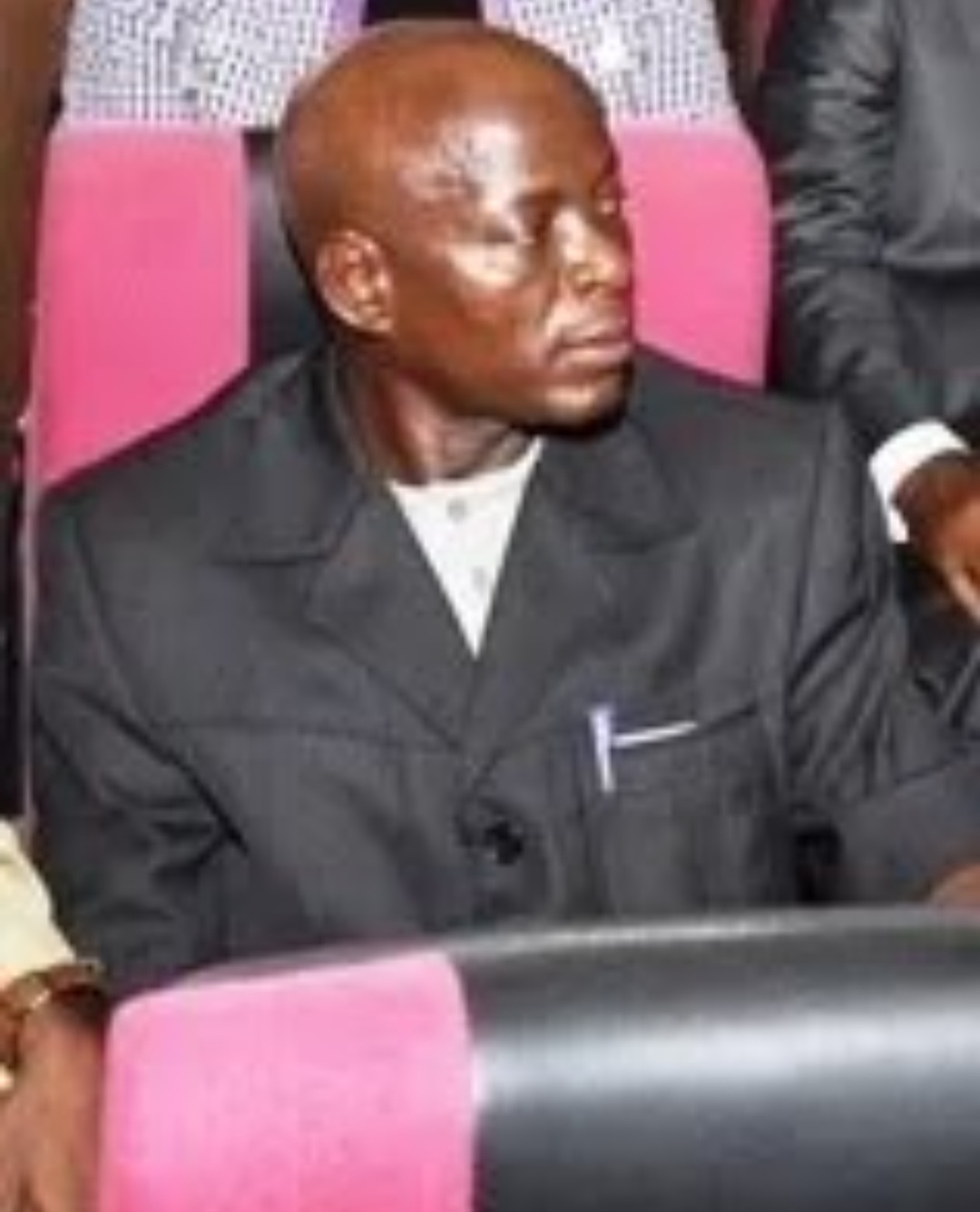

A former Accountant, Pensions Account, Office of the Head of Service of the Federation, Garba Tahir, was today, March 3, convicted and sentenced to 21 years imprisonment for stealing N26.1 million meant for pensioners.

Abdullahi was prosecuted by the Economic and Financial Crimes Commission at a Federal High Court, Abuja on a seven-count amended charge that bordered on money laundering.

The case is a part of the billion naira pension fraud in the Office of the Head of Service of Federation, for which a number of civil servants were investigated over ten years ago, and charged to court by the EFCC.

The Head, Media and Advocacy, Wilson Uwujaren, revealed this in a statement on Friday.

Count four of the charge reads, “That you, Garba Abdullahi Tahir (also known as Tahir Garba) on or about January 18, 2010 in Abuja within the jurisdiction of this Honourable Court converted the sum of N3million into cash by Ecobank cheque no. 92 drawn in favour of one Sani Abdullahi through your bank account with Ecobank Plc which sum represented part of the proceeds of crime of criminal breach of trust committed by you in the Office of the Head of Service of the Federation with the aim of concealing its illicit origin and you thereby committed an offence contrary to Section 14(1)(a) of the Money Laundering (Prohibition) Act, 2004 and punishable under section 14(1) of the same Act”.

Count six reads, “That you Garba Abdullahi Tahir (also known as Tahir Garba on or about April 12, 2010 in Abuja within the jurisdiction of this Honourable Court converted the sum of N7.8million into a bank draft or Manager’s Cheque in favour of CHARO Bureau de Change Ltd through your bank account with Ecobank Plc, which sum represented part of the proceeds of crime of criminal breach of trust committed by you in the Office of the Head of Service of the Federation with the aim of concealing its illicit origin and you thereby committed an offence contrary to Section 14(1)(a) of the Money Laundering (Prohibition) Act, 2004 and punishable under section 14(1) of the same Act”.

Count seven read reads, “That you, Garba Abdullahi Tahir (Also known as Tahir Garba) on or about May 17, 2010 in Abuja within the jurisdiction of this Honourable Court converted the sum of N7.5million into a bank draft or Manager’s Cheque in favour of CHARO Bureau de Change Ltd through your bank account with Ecobank Plc which sum represented part of the proceeds of crime of criminal breach of trust committed by you in the Office of the Head of Service of the Federation with the aim of concealing its illicit origin and you thereby committed an offence”.

The spokesperson for the EFCC further noted that Tahir had pleaded not guilty to the charges upon arraignment. But the case went into the trial with the prosecution calling several witnesses and tendering documents in evidence.

Uwujaren added, “Delivering judgment on Friday, Justice Inyang Ekwo said the prosecution had proved the case against the defendant and convicted him on all seven charges.

“The judge sentenced the defendant to three years imprisonment on each of the seven counts. The sentences are however to run concurrently from April 3, 2023.”

![]()