The woes of Heritage Bank, under the leadership of Akinola George-Taylor continue to deepen as court has ordered the immediate closure of the bank, according to ENigeria reported.

Heritage Bank which appears to have witnessed better days in its banking operations has continued to lose its battle for survival under the new leadership of George Taylor.

The growing concerns by customers of the distressed lender took a different turn as Honourable Justice (Dr.) I.J. Essien instructed the Inspector General of Police Olukayode Egbetokun in a court order to ensure police security for the Court’s Sheriffs in executing the Court’s directive to shut down operations of Heritage Bank with immediate effect.

This is following judgment in a garnishee order issued against Heritage Bank

in lawsuit tagged number MCN/MKD/07m/202, filed by Shehu Mudi .

According to the National Industrial Court seated in Makurdi, the capital city of Benue State, the garnishee order, instructs the immediate closure of Heritage Bank Limited, after it failed to remit an amount exceeding N710 million to Shehu Mudi and 656 other entities.

The Court maintained its stance that the bank’s branches must remain shut until it fully adheres to the directives outlined in the garnishee order.

This is coming amid heightened concerns by customers of the bank bordering on its faulty operations and inability to avail funds for withdrawals across the counter in several branches.

According to a report by The SUN, Justice Essien emphasized that the garnishee entity (Heritage Bank) had become an obstruction to the due process of justice.

The judge said that while considering the exhibits and arguments, he recalls the court made an Order Absolute in Exhibit A, which stipulated that the Garnishee should remit the Judgment amount being sought through this application within a span of 3 days.

He said this specific directive was further validated by the Court of Appeal and confirmed in Exhibit D, which is contained within its ruling and documented as Appeal Number CA(MK/26/2022).

He added that within this judgment, the Garnishee was explicitly instructed to fulfill the Judgment debt within a 3-day period.

Regrettably, despite the multiple orders that have been issued by both this Court and the Court of Appeal, Garnishee has continued to blatantly disregard the mandate laid out by this Court’s Order.

The judge ruled:

Further to this, despite the Garnishee’s undertaking to pay the Judgement sum to anywhere located in Nigeria until the Garnishee (Heritage Bank PLC), comply with the Order of the Court of Appeal directing it to pay to the judgment creditor the sum of N710,969,140.19 which is made up of the judgment sum and interest accrued from 14/12/2021 to December 2022 which sum has been set aside by the garnishee and party represented by the bond entered into at the Court of Appeal by the garnishee.

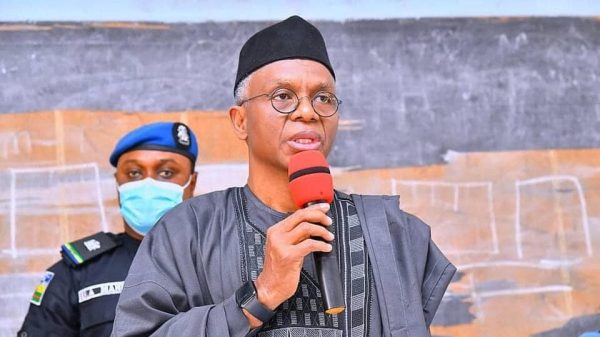

Heritage Bank continues to wallow in murky waters under the watch of its embattled Chief Executive, Akinola George Taylor who was recently entangled in an alleged messy boardroom crisis that saw the sacking of staff who are perceived as loyalists of his predecessor, Ifie Sekibo.

Despite a recent communication released by the bank days back assuaging the fear of its protesting customers, data perused through by ENigeria Newspaper proves otherwise.

Heritage Bank’s Boardroom crisis worsens, Ifie Sekibo’s loyalists edged out

You would recall that, months ago, ENigeria Newspaper reported that Ifie Sekibo, a banking legend and boardroom guru who was the founder of the bank bowed out upon the expiration of his tenure in line with the directive outlined by the apex bank.

This Newspaper exclusively reports that since his exit, things have reportedly further degenerated on the watch of the new helmsman, Akinola George-Taylor who is said to have allegedly connived with other members of the board to frustrate loyalists of his predecessor.

Even though George Taylor is faced with the huge challenge of reviving the fortunes of the ailing bank and drive growth, sources say he has instead, allegedly, instigated multiple internal crisis, in an attempt to rid the bank of those suspected to be loyalists of some board members, and employ his own people. This is according to an account by a reliable source in the bank.

“Some key members of the board, connived with the MD (George-Taylor) to sideline others who are considered to be loyal to Ifie and as for other members of staff who are in the same category, they have been sacked with immediate effect and that includes, Rilwan Dabiri, head of IT department in the bank and over 70 others”, the source said.

On the other hand, another source who spoke to us on the condition of anonymity said, “Although many have been sacked from the Bank, most of them have been indicted in one fraud or the other, thus their sacking by the new management is justified”. The source further stated that only a few who were hit by the mass sacking are victims of circumstance.

Heritage Bank’s Head of IT Diverts N49 Billion into Separate Accounts, Disappears

Meanwhile, ENigeria Newspaper also learned that Rilwan Dabiri upon exit handed over the IT department to his successor who is simply identified as Akin. Since resuming his new position as head of IT, Akin had allegedly been engaging in serious insider fraud which includes unauthorized transfer of funds from the bank’s coffers into private bank accounts which he secretly operates without the knowledge of his employers.

According to the bank’s structure, only the head of IT has sole access and operates the Finacle platform which is solely used for online transfer of funds in the financial sector. For this reason, Akin who has unfettered access to the platform seized the opportunity to initiate multiple transfers of about N49 billion into six accounts domiciled in six commercial banks in Nigeria.

His escapades were soon exposed following an internal audit per the instruction of the bank’s MD, George Taylor which reportedly exposed the mega fraud. Upon further interrogation, he was only able to drop one of the six accounts before disappearing and switching off his phone.

The management of the bank is afraid of inviting the Economic and Financial Crimes Commission (EFCC) to open an investigation for fear of stirring up the hornet nest.

It remains to be seen how the new leadership of Heritage Bank Plc under the watch of Akinola George-Taylor intends to steer the lender off troubled waters, but key indicators suggest that things are not good.

![]()