Policy-setting committee of the Central Bank of Nigeria (CBN) has raised the monetary policy rate (MPR), which measures interest rate, from 17.5 percent to 18 percent.

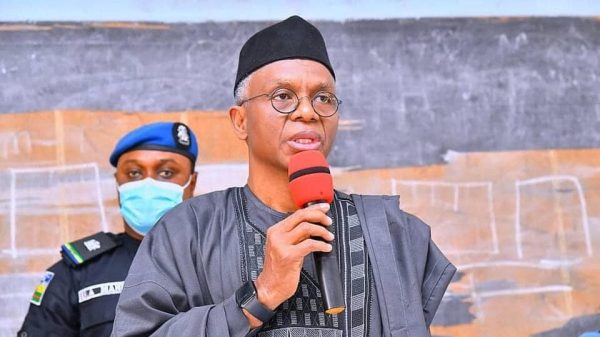

Godwin Emefiele, CBN Governor, disclosed this while reading the communiqué of the second MPC meeting of the year in Abuja on Tuesday.

Addressing journalists at the end of the two-day meeting, Emefiele, said the Committee voted to keep the asymmetric corridor at +100 and -500 basis points around the MPR.

The governor stated the slight increase is to mitigate the effect of inflation and other economic issues.

The MPR has been on the rise since April 2022, when it was 11.50 per cent.

The rate impacts lending and inflation rates, and, when jacked up, consequently affects upward movement of prices of goods and services.

He said, The MPC committee voted to raise the MPR by 50 basis point to 18 per cent, retain asymmetric corridor at +100 and -500 basis points around the MPR.”

![]()