Accurate and timely payroll impacts costs, tax compliance, and employee morale. Many organisations assume that insourced payroll is inherently superior. Yet in today’s dynamic business environment, this assumption can be more costly. It can burden valuable personnel, increase compliance risks, and saddle organisations with expensive, yet obsolete, software.

Workplaces are becoming more complex through a wide variety of employment conditions, frequent regulation changes, and growth risks (especially when operating in multiple regions). Payroll systems don’t always keep up, which is why over a third of companies are dissatisfied with their internal payroll systems.

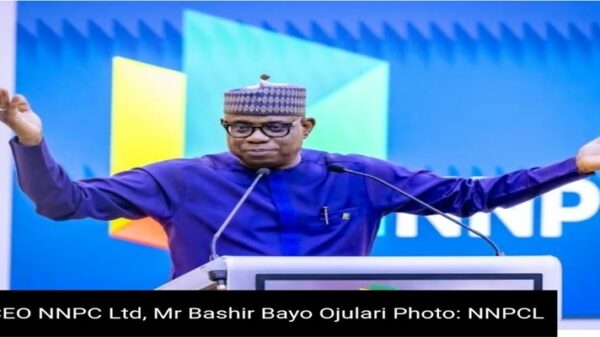

“The importance of accurate and timely payroll is undeniable. But assuming that insourcing payroll is inherently superior misses the mark. In today’s dynamic business environment, clinging to outdated internal systems is costly, diverts valuable personnel, and complicates software management,” says Heinrich Swanepoel, Head of Business Development at Deel Local Payroll, powered by PaySpace.

Outsourced payroll’s strategic advantages

Outsourcing payroll is a strategic move that adds scale and flexibility to an organisation’s operations. Whether it’s for five or five thousand employees, one office or multiple countries, using an experienced and technologically capable outsourced payroll provider creates crucial advantages in workforce management and adaptability.

Here are five key reasons why payroll outsourcing is a game-changer:

- Remove Legacy System Limitations and Costs: Outdated payroll software an expose you to delays, errors, and fragmented workflows. Outsourcing with modern technology provides flexibility. Providers can efficiently handle payroll tasks regardless of onboarding surges, market expansions, or workforce adjustments.

- Empower Staff for Higher-Impact Work: Outsourced experts add knowledge, coupled with payroll automation, secure collaboration tools, data integration, and enhanced financial visibility. They help key personnel in payroll, HR, and finance to focus on strategic, high-value priorities.

- Navigate Payroll Compliance: Outsourcing specialists make it their business to know local and international tax rules, labour laws, and data regulations. They use software with built-in compliance checks, audit trails, and secure document tracking. The provider shares and even inherits the responsibility of payroll software compliance such as GDPR, POPIA, SOC 1 & 2, and ISO 27001.

- Flexible payroll management: Outsourced payroll providers use scalable and flexible software to align with organisational changes, enabling their clients to adapt without reconfiguring payroll departments with restructuring or new hires.

- Access Advanced Features: Keeping up with new features and aligning them with operations is expensive and disruptive. Outsourced payroll providers introduce cutting-edge technologies like cloud computing, artificial intelligence, and data analytics as part of their core business strategies. They offer seamless integration with client business systems for real-time, fully compliant payroll operations that the client controls without adding technical risks.

Evaluating an outsourced payroll partner

Outsourcing payroll creates huge advantages. But not all outsourced payroll providers are the same. The best candidates combine human expertise with the advantages of modern cloud-native payroll platforms.

To evaluate a provider, test their payroll expertise and compliance knowledge. Security and data protection are non-negotiable, and assess their track record with other clients. Look at what software they use—the capabilities of the software and how well their people can use those features are as important as the staff’s professional capabilities. Are they masters of their tools as well as their craft?

Interrogate their service levels and how they extend capabilities to clients, such as self-service and ad hoc reporting. Evaluate the technology platform in terms of real-time data access, automated calculations, integration with HR and accounting tools, and compliance.

“Outsourcing payroll isn’t just about saving time — it’s a strategic move that positions your business for growth, compliance, and agility,” says Swanepoel. “With the right partner, you can reduce costs, streamline operations, and focus your energy where it matters most: on your people and your business.”

![]()