An Australian court has upheld a decision requiring X, formerly known as Twitter, to pay A$610,500 ($418,000) fine after failing to cooperate with a request from the nation’s eSafety Commissioner.

The request was for detailed information about the platform’s efforts to tackle child sexual exploitation material.

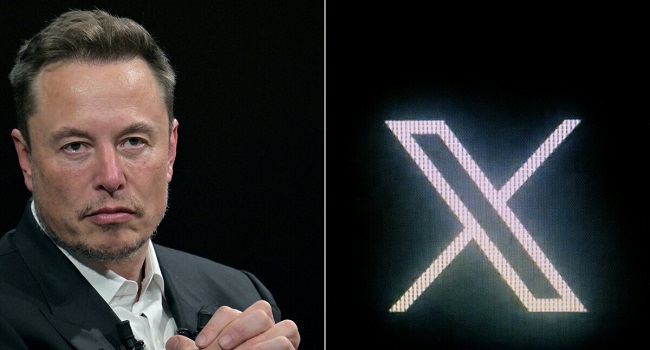

X initially contested the fine, arguing that a corporate restructuring in 2022, when Elon Musk took Twitter private and merged it into a new entity, freed the company from having to comply with the request issued in early 2023. However, the Federal Court of Australia disagreed, ruling that the platform was still bound to provide the information.

Julie Inman Grant, the eSafety Commissioner, noted that if accepted, it could have set a dangerous precedent. She stated that such corporate mergers could allow international companies to sidestep regulatory obligations in Australia, undermining internet safety efforts.

The penalty relates to a current inquiry into how tech companies, including X, are managing harmful content, particularly involving child protection. The eSafety Commissioner had requested specific details on the platform’s anti-child abuse strategies, which X failed to provide. In addition to the fine, civil proceedings have also been initiated against the company due to its noncompliance.

Musk’s X has faced previous clashes with the Australian internet safety regulator. Earlier this year, the eSafety office ordered the platform to remove content showing a violent incident involving a bishop being attacked during a sermon.

X challenged that directive, arguing that regulators in one nation should not dictate what content is visible worldwide. The Australian regulator eventually dropped the case, and X kept the posts online. Musk criticised the order, labelling it as an act of censorship and linked it to a larger agenda by international bodies like the World Economic Forum.

This latest legal setback adds to Musk’s growing list of challenges in managing the platform since his takeover, particularly as it continues to face questions from regulators around the world.

![]()