NetPlusDotCom, a leading Fintech and Digital Payment company, has collaborated with Zenith Bank Plc. on the Zenith Bank ‘SME Grow My Business’ initiative through the integration of the NetPOS Mini, a 2-in-1 innovative POS solution offering payment and merchant applications.

The NetPOS Mini launched into the Nigerian market early last year, is a device that doubles as both a SmartPhone and a POS terminal, and offers multiple payment channels for merchants, including Cards, Account Transfers, QR codes and USSD payments.

Asides having NFC built in, pre-installed business apps and a merchant dashboard, the device can also be used by the merchants to take orders by call, text or iMessages.

It comes pre-installed with STORM, the Super Merchant app, which provides inventory management, payment integration with social media, and sales tracker all in one.

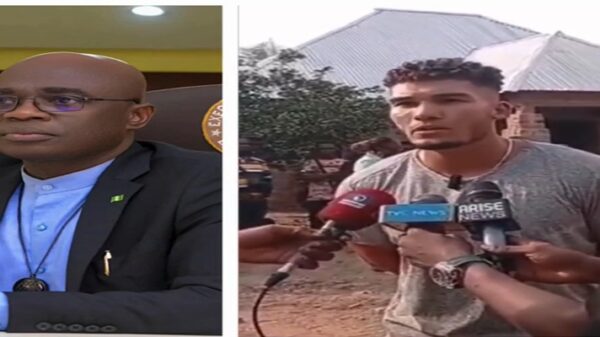

Speaking on the new banking product, Mr. Ebenezer Onyeagwu, Group Managing Director/Chief Executive of Zenith Bank Plc, said that: “SMEs remain the growth engine of any economy and Nigeria is no exception, with 96% of local businesses classified as SMEs according to the International Finance Corporation (IFC).

“This provides a huge space to deliver value and offer compelling propositions and engagement for business growth and contribute to national development”.

According to him, “the launch of the ‘SME Grow My Business’ product by the bank, therefore, stems from the desire to provide a unique platform for catering for the unique needs of SMEs who represent a major segment of the Nigerian economy”.

Zenith Bank has continued to distinguish itself in the Nigerian financial services industry through superior service offerings, unique customer experience and sound financial indices.

The Bank remains a clear leader in the digital space with several firsts in the deployment of innovative products, solutions and an assortment of alternative channels that ensure convenience, speed and safety of transactions.

![]()