Nigeria’s very first payment service bank, 9PSB and Africa’s leading payments technology company, Flutterwave have entered into a partnership agreement that will help facilitate seamless financial services for Nigerians.

In a joint statement issued by both companies, the partnership seeks to create a seamless payment ecosystem by aggregating and simplifying transactions for banking agents, merchants, and consumers.

The partnership will also support the drive for economic growth through empowerment of the SME sector, entrepreneurs in FinTech and other industries, as well as contribute to the transformation of the informal sector to formal.

Speaking at the MoU signing ceremony, held at the 9PSB head office in Lagos, the Chief Executive Officer, 9PSB, Branka Mracajac remarked that the collaboration between 9PSB and Flutterwave represents an important milestone in making banking services accessible to all.

According to her, the partnership supports both companies’ commitment to expand accessibility and serve as last-mile delivery of solutions to the unbanked, under-banked and underserved.

She said, “9PSB, being focused on the presence in unserved, rural, and remote areas, has a unique business model that provides Agent Banking as a Service to our partners to drive financial inclusion.

“Expanding on our promise to deliver relevant products, with this partnership, our existing agents, partners, and customers will have a single point of entry to enjoy various products and services provided by Flutterwave.”

With this partnership, Flutterwave and 9PSB are jointly launching a suite of products to enable other corporate entities, FinTech, technology and other industries to take advantage of the robust end-to-end system available for payments, collections, and transactions for both the banked and financially excluded Nigerians.

Commenting on the choice of 9PSB as its settlement bank, Founder and CEO, Flutterwave, Olugbenga Agboola noted that both companies share the same vision and are committed to one goal of powering seamless financial services.

“At Flutterwave, we believe in an ecosystem of shared value that transforms and impacts society. We are showcasing the power of strategic partnership and cross-sectoral collaboration in advancing Nigeria’s financial ecosystem,” he said.

A paper published by the CBN—Financial Inclusion in Nigeria; Issues and Challenges, admits that there is global consensus on the importance of financial inclusion due to its key role of bringing integrity and stability into an economy’s financial system as well as its role in fighting poverty in a sustainable manner.

The partnership between 9PSB and Flutterwave keys into various calls for interconnectivity and interoperability amongst stakeholders in the financial sector in accelerating the country’s financial inclusion drive to create prosperity and grow the economy.

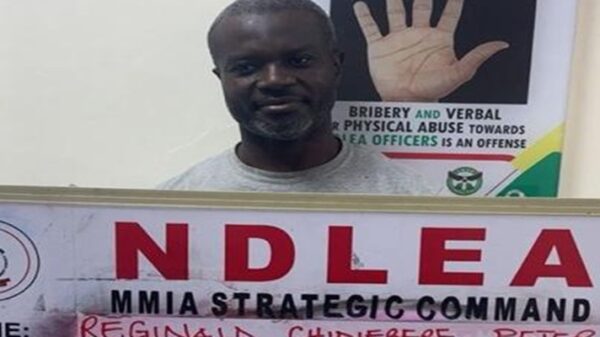

L-R: Branka Mracajac, Chief Executive Officer, 9 Payment Service Bank (9PSB) and Olugbenga Agboola, Founder and CEO, Flutterwave at the strategic partnership MoU signing event between 9PSB and Flutterwave which held at 9PSB headquarters, Victoria Island, Lagos.

![]()