Ifie Sekibo, MD/CEO of Heritage Bank Plc, has called on governments to provide enabling policies that would support private sector interventions to achieve the vision of infrastructural development.

He made this submission at the Finance Correspondents Association of Nigeria’s (FICAN) 30th-anniversary conference and awards with the theme: “Financing Infrastructure & SMEs for inclusive growth in the post-COVID-19 economy,” held over the weekend in Lagos, where the bank carted away duo Platinum Awards presented to Ifie Sekibo and Heritage Bank for Outstanding Support towards FICAN and Financial Reporting, respectively.

Sekibo who was represented by Olusegun Akanji, Divisional Head, Strategy and Business Solutions, argued that the government cannot solve the country’s infrastructure challenges, noting that it is the private sector that will deliver the solution.

According to him, the government can only provide enabling policies that will support private sector interventions.

“We need the global private sector intervention to help us achieve a vision of infrastructural development,” he said.

He noted that until the country developed an identity management system that delivers value to the citizenry, SMEs will continue to grapple with financing challenges.

He explained that though the banking industry has financed a lot of SMEs in terms of count, that it is the sector that has the largest numbers of bad loans and frauds in terms of count.

MD of FMDQ Group, Bola Koko represented by Yomi Osinubi, Head Private Market, urged Nigeria to conceive a way its domestic capital market could fund the international capital market.

That, he said, was the only way that we could pluck the infrastructure rewards.

“If we want to pluck our infrastructure rewards, first of all we have to conceive of a way our domestic capital market can actually fund capital market.

“But the investors in debt capital market international and debt, money will come into an environment where capital is expected and there is an expectation of good management of those resources and cash flows will come back to it.

“So I think there’s the issue of maybe an underlying structure where we want to put in capital like road infrastructure tax payment.

” If you want SMEs to get the best benefits of infrastructure development in the country, the CBN Governor mentioned the largest areas of course for SMEs which is energy. The second largest is the logistics, movements of cargo around the country,” he said.

Temidayo Obisan, Executive Commissioner, representing the Director General of Securities and Exchange Commission (SEC),Lamido yuguda advised that the nation connected the right duration of money which according to him would be long-term.

“The major thing to identify is that infrastructure is a long-term thing, so it Is essential we connect the right duration of money which is long term capital which is what capital market provides and which sec as a regulator should.

“We have about three surviving infrastructure focus funds in Nigeria now that are totalling almost a 100bn, itching about 90 billion at the moment and there are some that are registered programmes of 200billion,” he said.

More so, the Chairman of FICAN, Titus Chima Nwokoji, said if Nigeria’s infrastructural gap, which is estimated to be N36 trillion annually, is addressed, a lot of the country’s economic challenges will be easily tackled.

“And coming out of COVID-19 pandemic, we know that if the infrastructure is fixed and SMEs thrive, the growth that you see will be faster,” he added.

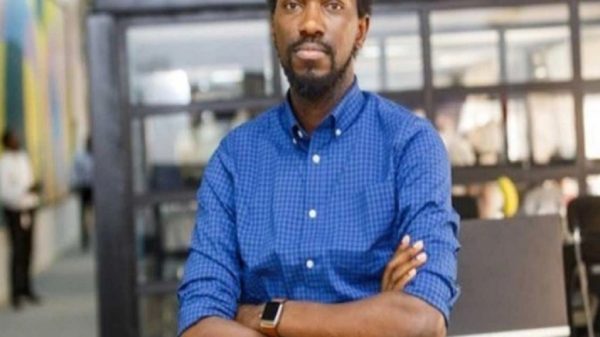

L-R: Blaise Udunze, Team Lead Media and External Relations of Heritage Bank Plc; former Managing Director of Bank of Industry, Waheed Olagunju and the Chairman of Finance Correspondents Association of Nigeria, Titus Nwokoji, during the duo Platinum Awards presented to Ifie Sekibo and Heritage Bank for Outstanding Support towards FICAN and Financial Reporting, respectively at the Finance Correspondents Association of Nigeria’s (FICAN) 30th-anniversary conference and awards with the theme: “Financing Infrastructure & SMEs for inclusive growth in the post-COVID-19 economy,” held in Lagos, weekend.

![]()