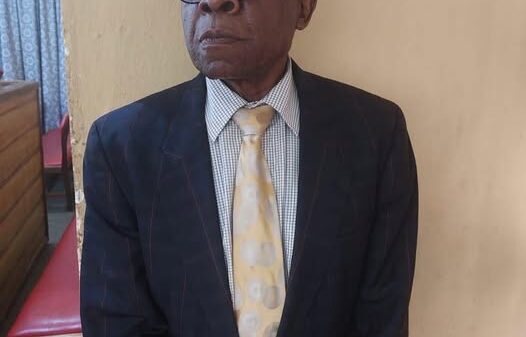

Mr. Ebenezer Onyeagwu, Group Managing Director/Chief Executive of Zenith Bank plc, has called for increased impact investing in Africa to enable it attain its full potential.

He made the call during his keynote address at the Africa Investment Risk & Compliance Summit 2021 organised by the Emerging Business Intelligence & Innovation (EBII) Group which held at the prestigious University of Oxford, United Kingdom, at the weekend.

Onyeagwu delivered his keynote address after the special keynote address by President Nana Addo Dankwa Akufo-Addo, who was Special Guest of Honour.

Also at the event was Dr Amani ABOU-ZEID, African Union Commissioner in charge of Infrastructure and Energy, who delivered a keynote address at the Summit.

Delivering the keynote address with the theme “Leveraging Impact Investment Opportunities for Growth in Africa”, Onyeagwu described impact investing as an investment that yields optimal returns for investors, value for all stakeholders, and guarantees continued sustenance and existence of humanity.

He decried the shallowness of Africa’s financial market as reflected in the fact that no African exchange is among the Morgan Stanley developed markets index, with only two African exchanges (Egypt and South Africa) in the MSCI Emerging Markets Index, and just six African exchanges in the MSCI Frontier Market Index.

He noted that although the International Finance Corporation (IFC) estimates that the global investors’ appetite for impact investing could total as much as $26 trillion, only approximately 8percent of the assets of impact intent funds are focused on Africa.

According to him, this is not significant enough, and Africa appears to be in the room but not on the table, considering that the continent is in dire need of investment with its estimated 1.3 billion people represent about 17percent of the global population of about 7.8 billion.

Citing the immense opportunities in Africa that represent enormous investment proposition for discerning investors, including the huge population, large market and active labour force, and the rich natural endowment, Onyeagwu described Africa as “the new frontier” for global growth.

He made a case for increased impact investment in in the continent noting that investment opportunities cut across agriculture, healthcare, housing, infrastructure, electricity, and the creative sectors.

Onyeagwu expressed optimism on the coming into effect of the African Continental Free Trade Area (AfCFTA) initiative, targeting to create a single, continent-wide market for goods and services, business and investment that grants investors access to the entire continent.

He also called on investors’ attention to Africa’s rich natural endowment, which includes 60percent of the world’s uncultivated arable land and 9 percent of the world’s freshwater bodies, noting that Africa holds enormous potential for organic food production.

He, therefore implored investors in the agribusiness value chain to focus attention in Africa for organic food production instead of genetically modified food in other climes.

Onyeagwu also noted that as a socially responsible organisation, Zenith Bank would continue to promote impact investment in Africa, stressing that the bank has maintained strong advocacy for investment in Africa through its flagship sponsorship of “Inside Africa” on CNN for 16 consecutive years, which is helping to highlight the immense creativity and talent that abound on the continent and the enormous investment opportunities on the African continent.

He also said that the bank leverages its in-depth knowledge of the African market to guide investors and hedge their exposures. According to him, the bank has been on a steady Environment, Social and Governance (ESG) investment journey, which started with ESG integration as a business strategy as well as being a signatory to the Nigerian Principles for Sustainable Banking and the United Nations Environment Programme Finance Initiative (UNEP FI) Principles for Responsible Banking.

![]()