VFD Microfinance Bank, manager of V Bank, Nigeria’s leading digital banking platform, and Autochek, the automotive technology company making car ownership more accessible and affordable across Africa, have joined forces to make it easier for businesses and consumers in Nigeria to access affordable financing for the vehicles they desire.

Cars are central to how Nigerians live and work. However, recent economic headwinds have pushed many businesses and individuals to prioritise affordability when considering the cars they would like to purchase. From the ongoing situation with access to foreign exchange and inflation to subsidy removal and other headwinds, these developments have impacted the cost of owning and maintaining vehicles in Nigeria and more Nigerians are exploring new ways to manage the situation more efficiently. Financing presents a viable option for making car ownership more accessible and affordable, for alleviating various transportation challenges and impacting the whole value chain including dealers, workshops, SMEs, and ultimately the consumer.

V Bank is committed to helping its customers achieve their desires and create wealth, and it is on a mission to become the number one provider of microfinance solutions for businesses and individuals in Nigeria. With this partnership, businesses and individuals will now be able to access the bank’s market-leading financing options when they apply for financing for their chosen vehicles. They simply need to find the vehicles they want to purchase on Autochek’s online marketplace or via a dealer in the company’s extensive network, submit an application for financing and they will be able to choose the V Bank option once their application has been approved. With a 30 percent equity contribution to the value of the new car and affordable monthly repayments, customers will also be able to access insurance, registration, maintenance, and other value-added services from accredited Autochek partners.

Similarly, Autochek has built the infrastructure to drive the penetration of auto financing across Africa, powered by a data analytics engine that makes it easier to offer credit for automotive purchases. Customers can get instant financing offers once the necessity criteria have been met. With operations in 9 countries across East, South, West, and North Africa, more than 70 banking partners, and a partner-led footprint of more than 2,000 dealers and workshop locations, the company has unrivaled access to insights on vehicle-related transactions that positions it to develop effective solutions for the continent’s automotive ecosystem.

Commenting on the partnership Mayokun Fadeyibi, COO at Autochek Marketplace, said “Vbank’s commitment to providing affordable financing aligns perfectly with our mission to drive the penetration of car financing across the continent, and we are excited to deepen our relationship with this collaboration. With our combined expertise, I am confident that we will be able to connect more customers to the financing they need to access the vehicles they desire, which should in turn catalyze more growth across the automotive sector and the economy at large.”

Commenting on the partnership between Vbank and Autochek, the MD, Gbenga Omolokun said:

“At Vbank, our mission has always been to empower and uplift our customers and we are guided by the core principles encapsulated within our brand positioning “Enabling you to achieve”. ACHIEVE is an acronym which captures our key focus areas with the letter V symbolizing Vehicle/Mobility.

This partnership with Autochek will bring forth a wave of opportunities for businesses and individuals alike, stimulating economic growth and driving progress across Nigeria. With Vbank’s financing options, a 30 percent equity contribution, and affordable monthly repayments, we aim to not only ease the burden of car ownership but also impact the entire value chain, benefiting dealers, workshops, SMEs, and, most importantly, the consumers we serve.”

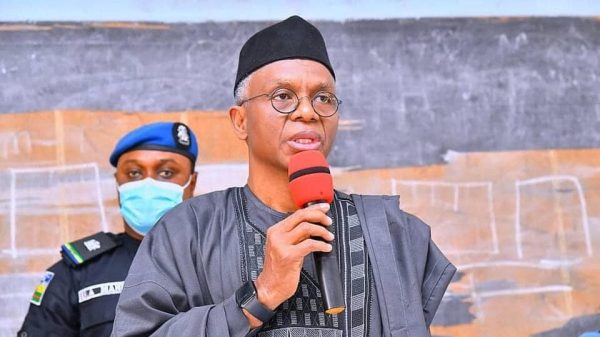

L-R: Gbenga Omolokun, MD, VFD Microfinance Bank (V Bank); Winifred Allison, Executive Director, Product and Marketing, VFD MFB; Mayokun Fadeyibi, Chief Operations Officer, and Philip Ayere, Senior Credit Manager, both of Autocheck Marketplace, at the press conference to announce the partnership between V Bank and Autocheck, in Lagos, yesterday.

![]()