SystemSpecs, has supported calls by stakeholders in Nigeria’s business ecosystem for increased broadband penetration to deepen financial inclusion as a means of social and economic transformation in the country.

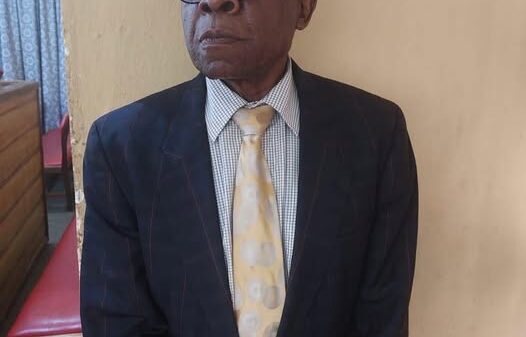

This was affirmed recently by ‘Deremi Atanda, SystemSpecs’ executive director, when he served as a speaker at the annual Bullion Lecture, organised by the Centre for Financial Journalism (CFJ), which held both virtually and physically in Lagos.

According to a 2018 World Bank report, financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs, including payments, savings and credit in a responsible and sustainable way.

A Boston Consulting Group (BCG) report had stated that a one per cent increase in financial inclusion increases real Gross Domestic Product (GDP) per capita by 3.6 per cent.

“We must continue to focus on those things we regard as national issues. If we say financial inclusion is an opportunity to bring the economically disadvantaged persons into the economic network that can improve their lives, then it should be at the forefront of all we do,” Atanda said.

He said although the Central bank of Nigeria, the Nigerian Communications Commission and other relevant government agencies have done a lot in improving financial inclusion, there was still a lot to be done.

“How do we leverage technology to make sure that disadvantaged Nigerians can have their quality of lives improved and a sense of belonging as Nigerians? What are the strategies to ensure that the average Nigerian can be economically empowered?” he asked.

Strongly recommending that stakeholders begin to more actively consider the country’s burgeoning fintech community as a key contributor to the attainment of the desired financial inclusion goals, he said the digital economy is an enabler of social transformation and economic empowerment.

Further in his comments, Atanda analysed the interception between broadband penetration and financial inclusion as well as the consequence on socio-economic improvement, saying “As we deepen the collaboration between stakeholders within and outside government, we need to know what has worked what is not working and what needs to be done differently.”

“I think there is still a lot more to be done. The engagement of regulators and non-governmental stakeholders should be very clear and be continuously progressive,” Atanda added.

According to Professor Umar Danbatta, executive vice chairman of the Nigerian Communications Commission (NCC) and keynote speaker at the event, in Nigeria, only 58.5 per cent of the adult population were financially included, participating in the formal economy as of 2016. Nigeria had a target of 80 percent financial inclusion by the end of 2020.

The NCC boss highlighted a number of initiatives being implemented by the commission to deepen the frontiers of digital access to financial inclusion. These include pervasive broadband drive, unstructured supplementary service data (USSD) integration, SIM registration and subscriber database audit, new numbering plan, MoU with the Central bank of Nigeria (CBN) on mobile money, collaboration with other institutions, and addressing risks associated with digital financial services.

Another speaker at the event, Chizor Malize, CEO of the Financial Institutions Training Centre (FITC), spoke about the importance of building digital infrastructure in order to grow the economy. She analysed how technology and telecommunications infrastructure have deepened development in the society.

“The importance of digital connectivity is seen in areas where government, individuals, organisations, communities and other stakeholders are connected in a way that engagement and interaction are easier,” Malize said.

![]()