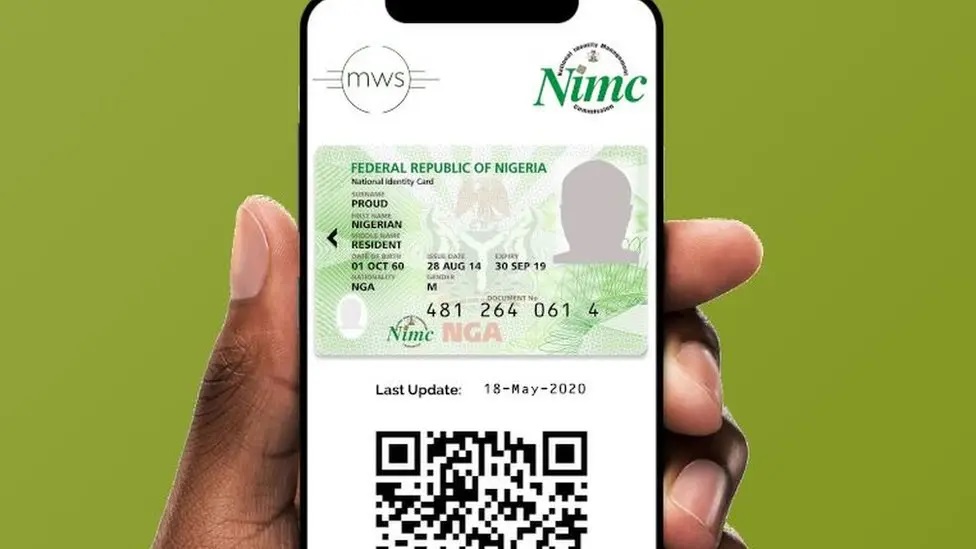

National Identity Management Commission (NIMC), in collaboration with Nigeria Inter-bank Settlement System (NIBSS) and the Central Bank of Nigeria (CBN), is set to launch an improved national identity card layered with payment capabilities.

The new, improved National ID Card will, beginning April, 2024, deliver social service programmes.

The initiative will be made possible through AFRIGOPAY Financial Services, which was launched as a national domestic card scheme by the CBN to perform domestic transactions within Nigeria, such as existing debit cards.

The newly improved national identity card, integrated with capabilities to facilitate payments and deliver social service programmes, operates under the mandate of the NIMC Act No. 23 of 2007, obliges NIMC to enroll and distribute General Multipurpose Cards (GMPC) to Nigerian citizens and legal residents.

Kayode Adegoke, head Corporate Communications, NIMC, in a statement, noted that the card responds to the need for physical identity tokens, allowing card-holders to authenticate their identity, access government and private services, and promote financial inclusion among marginalized Nigerians, fostering citizen empowerment and enhancing engagement in national development endeavors.

Card-holders, according to the NIMC statement, will have the flexibility to link the card to their preferred bank account as it functions as a debit, credit, or prepaid card for payments and activate same for access to multiple social programmes being driven by the federal government.

Only citizens and legal residents with a National Identification Number (NIN) are eligible to apply for the card, which can be requested at any commercial bank branch, via online portals accessible through banks’ web and mobile applications, other designated centres or at any NIMC office nationwide.

The NIMC upholds its commitment to safeguarding the personal data and privacy of all card-holders, adhering to international standards and best practices in data security, the statement added.

Key features of the card include:

- Biometric authentication, including fingerprint and photograph, for identity verification

- Offline capability enabling transactions in areas with limited network coverage

- Machine-readable Zone (MRZ) containing e-passport information

- Identity Card Issue Date displayed on the card

Additional features encompassing travel, health, insurance information, and other pertinent personal data for identification and verification stored in the chip

Functionality as a debit and prepaid card catering to both banked and unbanked individuals

![]()