Monday Sule Ilemona, a staff of United Bank for Africa UBA, has duped five customers, N15 million naira, ‘right inside the bank.

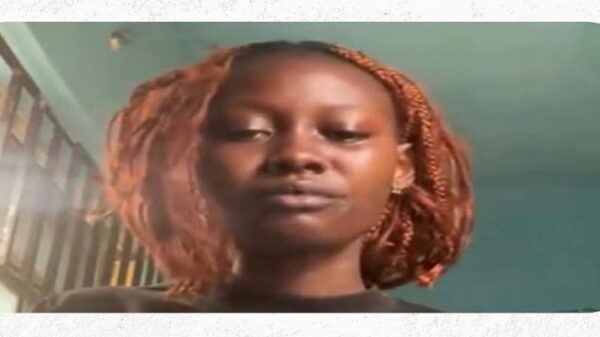

Ravenewsonline.com reports that Mberede Lovelyn Chiamaka is one of the victims.

She takes a deep breath as she hugs her nine-month-old baby when I ask her what happened to the N11 million she and her husband put into the United Bank for Africa’s (UBA) Target Account.

UBA Target Account is an account with high interest rates that is specifically designed for individuals to save towards a project, with a minimum operating balance of N50,000.

For four years, Chiamaka had been operating a UBA account. She opened her account at Oba Akran, Lagos, where she and her husband had been fixing their money through her own account at the banks treasury bill. She told Foundation for Investigative Journalism, FIJ, that anytime they fixed their money, they always obtained a certificate of investment from UBA.

In 2019, while her husband, Onuba Julius, was at their shop at Oshodi Express, along Charity Road, where they sold cosmetics and hair extensions in wholesale, he was approached by a staff member of UBA, Monday Sule Ilemona, who marketed the UBA Target Account to them. Onuba explained to Monday that they already had an account with UBA where they fixed money. This explanation did not deter Monday.

He sought to know the platform they fixed their money in, and when he was told that it was treasury bills, Monday found a perfect opportunity to market UBA Target Account.

Monday explained that treasury bills was fixing money with the Federal Government through UBA, while the UBA Target Account was directly fixing money with UBA.

He further convinced Onuba that if they had enough turnover in their target account, they would be granted a loan from UBA to expand their business. In addition to all these, Monday explained that UBA gave gifts to those who ran UBA Target Accounts, depending on the amount of money that was fixed.

When Onuba got home, he gave Chiamaka a download of everything Monday had told him. He also suggested that instead of going to the Oba Akran branch where they had been using, it was more convenient to use the Oshodi branch that was close to their shop to renew their fixed deposit. This decision would lead to a downward spiral that both husband and wife would struggle to recover from. When they started using the Oshodi branch, Monday became their account manager and had unfettered access to their accounts.

He had asked Chiamaka and her husband to write a letter to change account officers from the person who was managing it before to him.

CONFIRMED: MONDAY ILEMONA WORKED FOR UBA

But first, Chiamaka and her husband went to the Oshodi branch to confirm if Monday Sule Ilemona was really a staff of UBA. In the bank, they saw Monday upstairs, in his office, with his identity card, working on a laptop like other staff. This, for them, was a confirmation that at least, Monday was authentic. Monday took the couple to the branch manager, Oyekunle Oyetunde, introducing them to him as his new customers.

They detailed out what Monday had told them, and confirmed from Oyekunle if everything Monday had said was true. Oyekunle answered in the affirmative and gave Monday the percentage of interest that would be used for the amount they wanted to fix.

Chiamaka told FIJ, “Based on the information we got from the branch manager, we had the confidence that what he told us was real. We never knew that it would come out to be a fraud.”

The last money Chiamaka had fixed at UBA with the treasury bills was N9million. After she and her husband had come to a decision following a meeting with the branch manager, they decided to try out the UBA Target Account.

They met Oyekunle again and told him they’d like to fix their money. Monday was called to attend to them. Still, they were hesitant to put in all their money at once and told Monday that they weren’t going to put all the N9million into the new package (UBA Target Account) that had just been introduced to them. Around November 2019, Chiamaka fixed N7million in the treasury bill and N2 million in the Target Account so that they could familiarize themselves with how it worked. Monday brought out a form and asked Chiamaka to write her name and sign on it.

“Monday was filling other parts of the form. I asked him what are you filling? Monday said that that side would be filled by him, by the bank, not by me,” Chiamaka said.

A SUSPICIOUS DEBIT ALERT

Monday Ilemona sharing a bag of rice as part of the gifts that comes with opening a UBA Target Account.

She later did a thumbprint and left the bank for her shop. At her shop she received a debit alert of N2 million with Monday’s name appearing instead of UBA as she would have expected.

Immediately, she returned to the bank and confronted Monday, but he explained that since he was the account manager, anytime they fixed money with UBA Target Account, it was his name that would appear.

Chiamaka’s experience with fixing money in the treasury bill was different. She told Monday that when she used to fix the money, it was UBA and not any individual’s name that she saw in the debit alert.

“He said that all the debit and credit alert on Target Accounts must show your account officer’s name,” she recalled.

Monday had an explanation for her observation. The treasury bills involved the Federal Government and not UBA directly. But UBA Target Accounts involve UBA directly and therefore his name would appear in the debits because he was the account manager.

This was enough explanation to keep Chiamaka’s suspicion away. Her suspicion had also further been lowered after she had met Oyekunle, the branch manager, and had asked for a certificate to show she had fixed her money at the UBA Target Account.

“The manager told me that they didn’t give certificate on Target Account, that they only gave certificate on treasury bills,” Chiamaka said.

When Chiamaka received interest from the Target Account, it was a confirmation that put her at ease as to the genuinity of the product. When Monday started bringing bags of rice to their house, with a form that she was required to sign that showed she had received the gift, it cemented Chiamaka’s belief in the UBA Target Account.

Ravenewsonline.com also learnt that Monday would also take pictures, saying it was the evidence he required to show his manager that the gift had been received.

“Just name, date, signature, that’s the only thing written on it (the UBA letter headed paper),” Chiamaka told FIJ.

At the expiration date of the N7million in the treasury bill, Chiamaka and her husband transferred the money to their Target Account.

“The total money in my own account that my husband and I fixed was N10.5 million. My husband fixed N3 million through his own account,” she said.

When her neighbours indicated interest in fixing their money, they shared their experience with Target Account and met with Monday at the UBA branch at Oshodi. In total, her neighbours fixed N1.8 million.

START OF A LONG DECEPTION GAME

Soon, the front of their shop was converted to a park that loads buses to Ikotun; it affected sales. This led them to rent out their shop and get another shop elsewhere. The amount her husband was paid for renting out the shop was N2 million.

Then the deception started. Monday told them he had been transferred from the Oshodi Branch to 7&8 Ajao. It was in October 2020 that Onuba met Monday at the 7&8 UBA Branch and fixed the last N2 million into the Target Account. Then Monday started becoming elusive.

When Chiamaka asked about the loan, which was the major reason she and her husband decided to open a UBA Target Account, Monday’s response was discouraging.

The loan was to help them open a supermarket at Oshodi, but it no longer looked feasible.

When Chiamaka no longer received interest, Monday explained that it was due to Covid-19, which had affected banks. He then asked her to top up her account, which would then get the interest higher.

Chiamaka borrowed N500,000 and made the top-up, yet she did not receive her interest. A distressed Chiamaka said she was told by Monday that his manager would credit her account manually.

On October 27, very early in the morning, Chiamaka went with her husband to the new branch Monday had resumed at. Prior to that time, Monday had told Chiamaka and her husband to always inform him whenever they were coming to the bank. Chiamaka had just given birth, and most of her interaction at the time was when she was pregnant. When they met with the new manager at the new branch, they requested to know the exact month they would receive their interest.

BACK TO SQUARE ONE

After checking their account, the new manager told them they did not fix any money with UBA. As Chiamaka explains what happened, it is as if she is reliving the horrible experience all over. As if she is trying to put her head around the ordeal. As an argument ensued with the branch manager, Monday walked into the bank, wearing his trademark suit.

FIJ spoke to a UBA customer care official who said an account manager has no right to conduct transactions on behalf of a client. This was however not the case with Monday. When Monday was asked to go to the manager’s office, he was surprised to see Chiamaka, her husband and her neighbour inside. When the bank statement of the trio was printed, all they saw were transactions that showed transfers to Monday.

“So all the money we had been fixing, all of them were transferred to Monday’s personal account without our knowledge. All the interest we received also showed that Monday credited Lovelyn (Chiamaka’s English name).”

This shock made Chiamaka faint and unconscious for more than 30 minutes. At the time, Chiamaka’s baby was two months old, and her neighbour was nine months pregnant. They had rented out their shop, fixed the last money, and found themselves back to square one.

“There was no shop to go to, no house to feed.” Chiamaka said, exasperated.

When Monday was asked to explain what happened, he admitted to owing them but that they were doing a

He was trying to remove the bank from the whole situation,” Chiamaka said.

When Chiamaka asked Monday to define the kind of business they had, he was unable to. Monday’s direct supervisor, Chris Nsude, came down to the 7&8 UBA branch and separated Monday from the complainants. He then asked Monday to write a statement.

In the process, Monday tried to escape but unknown to him, all doors had been locked by the bank security who had been earlier alerted by the branch manager.

He was arrested by the policeman attached to the bank and taken to a police station before being transferred to Area F where he was detained.

‘MONDAY – NOT UBA’

Chiamaka told FIJ that according to the police, when they printed Monday’s statement of account, the only money they saw was N26,000. At the police station, Monday could not state the business he had with Chiamaka and the other clients he had swindled.

At the police station, Monday’s supervisor, Chris, dropped N120,000 with the police as money for further investigation, Chiamaka said. But the next day when they got to Area F, the police said no one should mention UBA and that Chiamaka and those Monday had swindled had no business with UBA.

The police said they had arrested the suspect, Monday, and Monday was the one who was to pay back the money, not UBA.

FIJ spoke with a lawyer, Rita Uzoma Okolo, who said that UBA should be held liable if a staff member defrauded the customer “in the course of his business and while carrying out his duties as a staff of the bank”.

“If however it was personal business between the two people, outside of the bank, the bank cannot be held liable for what their staff did outside the scope of his duties,” she said.

In a letter to Chiamaka’s lawyers, UBA’s Legal Services Division said Monday Sule was “an employee of one of the companies that provide the Bank with outsourced services”. It further stated that the defrauded clients “had a personal business arrangement with Monday Sule”.

It also noted that “it is trite that banking investments are evidenced with a certificate of investment, and deposits are evidenced by slips/receipts”. Monday had transferred the money into his account without giving them bank slips as evidence of payment.

“We did not know that all the money was transferred to his personal account. When the police asked him, he said he used to keep the copies to himself,” Chiamaka said.

Chiamaka told FIJ that at the police station, her husband fainted and his blood pressure shot up. A petition was written to transfer the case from Area F police to Zone 2, Onikan where another investigation was opened.

During the investigation, a lady claiming to be Monday’s older sister gave a call to Chiamaka, begging her to allow Monday attend his mother’s burial.

She told Chiamaka that Monday worked in Fidelity Bank in Abuja, and also defrauded some people at Fidelity Bank. At Zone 2, Monday tried to escape from the cell before he was taken to the Magistrate Court at Ebute Metta, where the case was to appear on January 19.

Monday did not appear in court on the claims that he was hospitalised. A warrant for the re-arrest of Monday was issued by the Chief Magistrate and the case adjourned to April 6. But getting to the court, it was closed because there was a strike.

When one of Chiamaka’s brothers-in-law chatted with Monday on Whatsapp, he got a response that he was in Ghana. When Chiamaka called the prosecutor to follow up on the case, the prosecutor said Monday’s bail bond disappeared from court and even those who served as sureties for Monday were untraceable. Monday had changed his phone number and was nowhere to be found.

“Till now, Monday has not called. UBA has refused to pay the money. Monday refused to pay. We don’t have any hope of living again; that’s just the truth,” Chiamaka said, close to tears.

At the time of this report, the whereabouts of Monday was unknown. When FIJ asked Chris, Monday’s supervisor for comments, he said he wasn’t at liberty to divulge such information as UBA was already aware of the case.

UBA Begins ‘Immediate Investigation’

The United Bank for Africa (UBA) says it has begun investigations into the fraud case involving one of its staff, Monday Sule Ilemona, who fleeced five customers of N15million while operating straight from the bank premises.

Speaking with FIJ on Thursday afternoon, Ramon Nasir, UBA’s Group Head of Media and External Relations, said immediately after seeing the story, the began investigating the issue towards finding an immediate resolution to the matter.

“I can assure you that from the responses I have had this morning, the investigation is ongoing. This issue will be resolved and an amicable resolution will be made,” he said.

It is, however, unclear if the matter has been resolved and victims refunded of their monies.

![]()