Godwin Emefiele, Governor of Central Bank of Nigeria on Thursday August 25, inaugurated the unstructured supplementary service data (USSD) code for the eNaira to enhance financial inclusion in the country.

Emefiele who was represented by Folashodun Adenisi-Shonubi, CBN’s Deputy Governor of Operations at a five-day Northern eNaira fair 2022, in Kano, said the new code — *997# — was introduced to engender financial inclusion and avail Nigerians opportunities endless possibilities through financial services.

He also said that the eNaira is a strategic initiative developed in accordance with the bank’s mandate to preserve monetary and financial stability.

Read Also: More Than $100m Worth of NFTs Stolen in One Year – Report Shows

Emefiele said; “It captured the slogan ‘same naira, more possibilities’, and designed to positively impact lives of Nigerians, and transform the economy.

“The eNaira is expected to enhance inclusion, support poverty reduction, enable direct welfare disbursement to citizens, support a resilient payments ecosystem, improve availability and usability of central bank money.”

The CBN Governor who expressed hope of the eNaira facilitating diaspora remittances, reducing the cost of processing cash, and improving the efficiency of cross-border payments, among others, also revealed that approximately 45 percent of Nigerians do not have bank accounts, while 35.9 percent are excluded from formal financial services.

He added that about 81 percent of the adult population in Nigeria representing 86 million of the 106 million, own mobile phones.

Emefiele said; “In addition, there are 150 million mobile subscribers in Nigeria, according to NCC, June 2022.

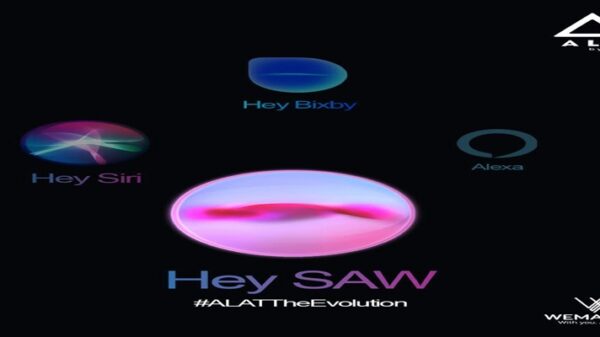

“Therefore, eNaira seeks to leverage the huge opportunity mobile telecommunication presents, as a distribution channel, for the offering of digital services to the underserved and unbanked population.”

![]()