Central Bank of Nigeria (CBN) has blamed the dispute between telcos and deposit money banks (DMBs) over non-payment for the provision of the Unrestructured Supplementary Service Data (USSD) to bank users by service providers on technical issues.

The technical issues the apex banks claims regards the definition of a successful transaction from a bank and telco perspective.

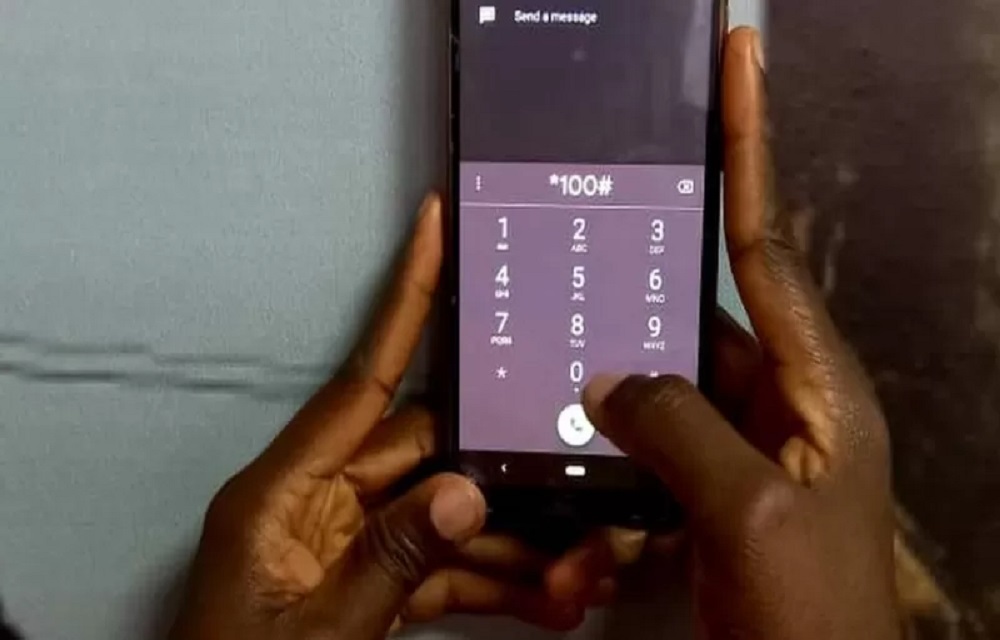

Recall that telecoms operators in Nigeria had on Friday withdrawn their services to banks, causing customers difficulty in accessing online banking transactions that depend on the platform.

These are transactions conducted on mobile phones like fund transfers through shortcodes, and checking of bank details and account balances, among other services with or without data or internet services.

But in a statement yesterday, Dr. Isa Abdulmumin, spokesperson for the CBN, explained that the apex bank was on top of the situation, blaming the dispute on technical issues regarding the definition of a successful transaction from a bank and telco perspective.

He said, “The CBN is very much aware of the protracted dispute between the banks and telcos and has been engaging all stakeholders to ensure an amicable resolution.

“Indeed, it was due to the direct intervention of the CBN (or CBN Governor) in March 2021 that a per session price of N6.98 (including settling any outstanding fees) was agreed upon between the banks and telcos.

“As far as we are aware, since 2021, DMBs continue to collect the USSD fees and remit the same on behalf of the telcos based on that agreement.

“We understand the latest dispute concerns technical issues regarding the definition of a successful transaction from a bank and telco perspective.

The apex bank’s image maker explained that the USSD fees are charged by DMBs using an automated system which bills the customer for a successful transaction only after a banking service is consumed.

He explained further that for the telcos, a successful transaction happens once the customer has dialled the USSD short-code which may not lead to the consummation of a banking service.

“Whilst such truncated transactions are not registered on the DMBs collection platform and thus not billed to bank customers, telcos expect the DMBs to charge customers once the short-code is dialled, whether or not a financial transaction is consummated.,” he said.

Giving a further explanation of the role of the CBN, Abdulmumin said “At a recent meeting of the DMBs & Telco representatives chaired by the Governor of the CBN to resolve the issue, he acknowledged the telcos right to collect all legitimately earned fees due to them and to recover their cost.

“Following the discussion, the direct billing model was proposed as a lasting solution to the issue. This would enable telcos full visibility of USSD transactions and allow them to charge their customers directly. The feasibility of the model is still being worked out by the relevant stakeholders.”

He described the USSD as a critical channel leveraged primarily by the financially excluded, vulnerable and critical mass, saying the CBN remains committed to ensuring that the areas of contention related to the selection of telco charges for USSD are resolved in the interest of the financial system and overall economy.

![]()