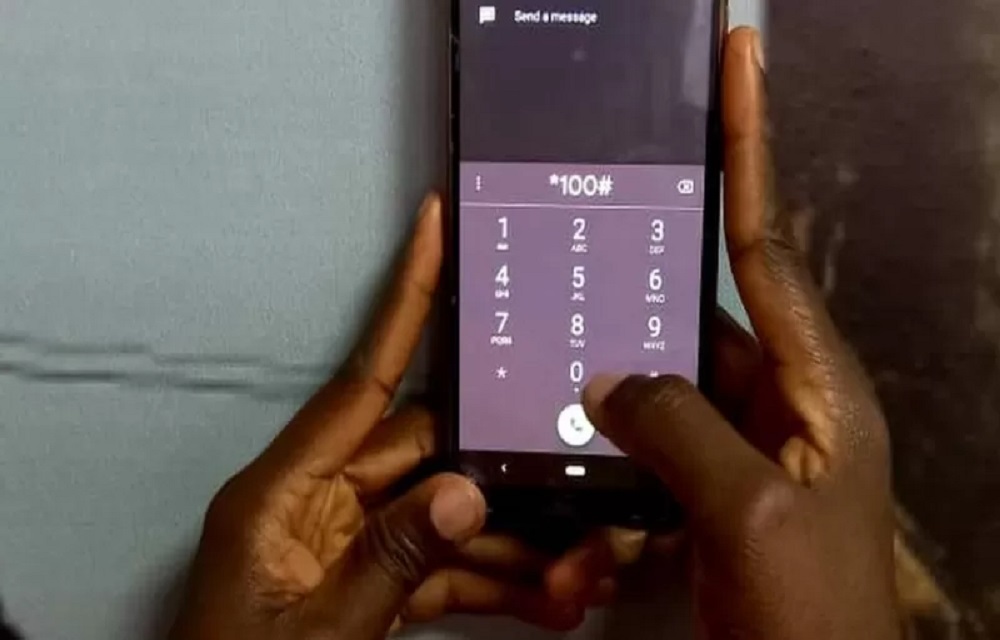

The Unstructured Supplementary Service Data (USSD) platform is experiencing an extensive crisis, and although talks between the banks and telecommunications operators are ongoing at the regulatory level to find a cooperative solution, the service providers claimed that the debts owed them by defaulting banks have reached N120 billion.

Bizwatchnigeria.ng reported that some N100 billion in indebtedness as of the first quarter of 2023.

However, despite the fact that the amount still owing has increased by N20 billion, the Association of Licensed Telecoms Operators of Nigeria (ALTON) claimed that the banks are still withholding remittances.

Gbenga Adebayo, chairman, ALTON, stated that the company’s debt had reached N120 billion, who verified that there had been regulatory-level conversation, stated: “Discussions are ongoing, and there has been very high-level regulatory intervention by the Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC).

While some banks are making payments, others appear to be holding off until the service is discontinued in an effort to test our persistence in getting them to do so.”

“We would temporarily stop providing USSD service to debtor banks if the CBN/NCC intervention fails. No industry can endure the amount of the mounting debt, which is currently in the neighborhood of N120 billion, He said.

“Because these are services for which money has been taken from their customers, the banks have a moral obligation.” The Ministry of Communications and Digital Economy, CBN, and NCC had underlined that starting on March 16, 2021, USSD services would be taxed at a flat rate of N6.98k per transaction, despite the fact that the crisis has been ongoing for more than five years.

According to the agreement, banks would not charge customers extra fees for using the USSD channel and would instead collect the new USSD fees directly from customers on behalf of mobile network operators (MNOs).

A typical USSD session, which lasted for 20 seconds, had a pricing cap set at $4.98 for each session prior to the N6.98k per transaction regime.

When the N6.98k problem reached a breaking point, NCC and CBN issued a joint statement that said: “This replaces the current per session billing system, providing a considerably cheaper average cost for subscribers to improve financial inclusion. This method is open and will guarantee that the sum stays the same regardless of how many sessions are involved in a single transaction.

While ePayment transactions reached N49.48 trillion in March, service quality difficulties in the area continue unabatedly and pose a threat to the sector’s successes.

Investigation by bizwatchnigeria.ng revealed that customers are still dissatisfied with the bank apps and USSD platforms they use to access services, which they complained were frequently very slow and unresponsive.

Due to this problem, many clients now swarm the banking halls virtually every day to voice their objections. Kehinde Alesh, a Zenith Bank client, revealed that the bank’s app was unresponsive last week. “We were unable to use the banking app for over two days. Even more shocking, the app crashed. Many transactions are still pending. The Central Bank of Nigeria must take action on this issue, He stated.

Banks must make greater infrastructure investments! The software is sluggish, and USSD transactions don’t work. To witness the crowd, you ought to have been at the bank. Just annoying, really. Before the sector collapses, the CBN needs to move quickly.

In addition to the demand for the availability of the new notes, Gabriel Okeowo, Country Director of BudgiT Foundation Nigeria, recently discussed the bank’s IT infrastructure.

If the old Naira notes are what are now in use, even the new Naira notes cannot be purchased. Additionally, as we speak, the lines are still present, electronic transactions are still declining, and money is typically not refunded within 24 hours.

“In addition, the Internet infrastructure is not sufficiently developed to support efficient electronic transactions. I see a potential of extending the deadline for the usage of old naira.

![]()