The African Development Bank Group yesterday signed a $400,000 grant agreement with the Securities and Exchange Commission of Nigeria to strengthen securities market regulation and broaden market instruments.

The funds will go towards strengthening the risk-based supervision framework, regulation of derivatives and green bonds, and build capacity for green finance. The grant will be sourced from the Capital Markets Development Trust Fund, a multi-donor fund administered by the Bank.

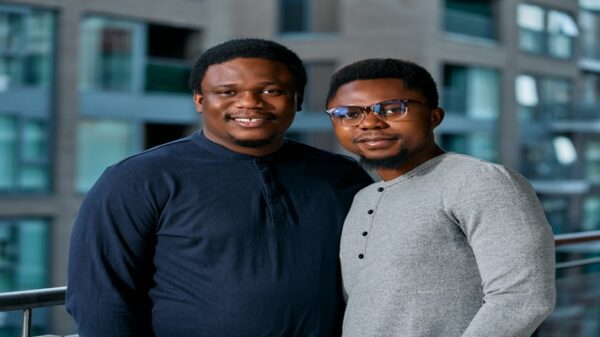

“This collaboration further underscores our mutual goal to grow our markets and create viable avenues for sustainable economic development for Nigeria and the region,” said Lamido Yuguda, Director General of the Securities and Exchange Commission at the virtual signing ceremony.

The grant is aligned with the priorities of the Bank’s Country Strategy for Nigeria, which envisages measures to stimulate capital market development to unlock financial resources for productive sector investments, infrastructure development and private sector growth.

Lamin Barrow, Senior Director of the Bank’s Nigeria Country Department, noted the urgency of the implementation of the project.

“At a time when countries are striving to build back better from the ravages of the COVID-19 pandemic, improvement of the enabling regulatory and supervision framework will boost domestic resource mobilisation efforts and leverage private sector contributions to achieve a greener, more environmentally sustainable and inclusive post-pandemic recovery,” Barrow said.

Oscar Onyema, Chief Executive Officer of the Nigerian Stock Exchange, thanked the African Development Bank Group and the Securities and Exchange Commission “for this historic event and partnership, to build in-house capacity at SEC, the Nigerian Stock Exchange, issuers and investors in the sustainable finance space, which will help to meet climate finance commitments in Nigeria.”

The project will support the implementation of the SEC’s Nigeria Capital Market Master Plan 2015-2025 and its vision to position Nigeria’s capital market as a competitive and attractive destination for portfolio investments.

![]()