Union Bank of Nigeria PLC, one of the old generation deposit money banks (DMBs) in Nigeria is currently enmeshed in alleged N1.9 billion fraud saga, THE WITNESS exclusively reports.

This online newspaper further gathered that also indicted in the alleged fraud were three former management officers of the bank.

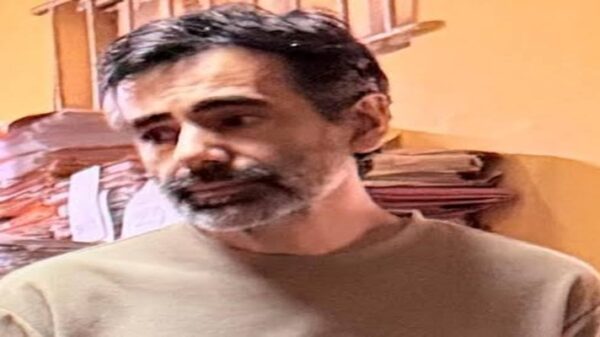

Barely five months after his retirement in March 31, 2021, Mr. Emeka Emuwa, a former chief executive officer of the lender, will be facing corruption charges and possible arraignment by the Economic and Financial Crimes Commission, EFCC, over his alleged involvement in the N1.9 billion scandal.

The EFCC had filed a five-count charge against the former CEO and three others bothering on conspiracy, stealing and dishonest conversion of the funds before a Lagos State high court.

Emuwa, who led the financial institution for eight years, we gathered, is to be arraigned with Union Bank alongside Mrs. Oyinkan Adewale, its former director and chief financial officer, Mr. Adeoye Oluwagenga, its former finance controller, over the alleged fraud and theft.

The former CEO, who joined Union Bank in November 2012, following a $500 million investment by Union Global Partners, was alleged to have conspired and stolen the sum of N1,927,836,804 belonging to Aso Savings and Loans PLC, sometime in 2014.

The EFCC prosecutors, Joy J. Amahian and Franklin Ofoma, said the offences contravened Sections 411, 285 (1), 278 (1) and 328 (1) of the Criminal Law of Lagos State, 2015.

However, the earlier arraignment of all the defendants which was fixed for the 4th and 5th of August was stalled as a result of the inability of the EFCC to produce the defendants before the court.

According to the charge with suit No: ID/14355C/2021, dated February 17, 2021, seen by The Moment Nigeria, Emeka Emuwa, Adeoye Oluwagbenga, Oyinkan Adewale and Union Bank Plc, with intent to conceal legal origins, transferred to themselves “the sum of N1, 927, 836, 804 billion belonging to Aso Savings and Loans PLC.”

The charge was brought pursuant to a petition to the EFCC by a law firm, AEC Legal, dated 5th April 2018 and titled: “Criminal Complaint Of Fraudulent Misrepresentation And Diversion Of N1,927,836,8049 (One Billion, Nine Hundred And Twenty Seven Million, Eight Hundred And Thirty Six Thousand, Eight Hundred And Four Naira) And Criminal Conspiracy To Defraud By Mr. Emeka Emuwa And Other Principal Officers Of Union Bank Of Nigeria Plc”.

As contained in the petition, “We make this criminal complaint of misrepresentation and diversion against Mr Emeka Emuwa, the managing director of Union Bank of Nigeria Plc and other principal officers of Union Bank Nigeria Plc with address at Stallion House 36, Marina Lagos.

“Mr Emeka Emuwa and other principals of Union Bank of Nigeria Plc sold Union Homes Savings & Loans Plc (UHSL) to our client (Aso Savings and Loans PLC) for the total sum of N5 billion. At the time of negotiations of the sale and purchase agreement of the UHSL, our client was informed that UHSL’s shares in Union Assurance company PLC, valued at N1,134,615, 384 formed part of its asset of UHSL to be acquired by our client.

“It therefore came as a shock to our client to discover, upon the conclusion of sales, that Emeka Emuwa and other principal officers of the bank had sold off UHSL’s shares in Union Assurance Plc to Greenoaks Global Holdings Limited and realised that the sum of N1,927,836,804 from the sale.

“More shocking is that there are no records whatsoever showing that the proceeds of sale of the Union Assurance Plc was paid into UHSL’s account or financial records.

“Our client has confronted Emeka Emuwa with this allegation but he has failed to proffer any explanation nor made any attempt to account for the proceeds of the sale.

“It is obvious that Mr Emuwa and his cohorts fraudulently diverted our client’s money in the tune of N1,927,836,804 and have no intentions of returning same”.

Union Bank is currently being led by Emeka Okonkwo. His appointment took effect in April 2021 following the retirement of Mr. Emuwa.

The matter has been adjourned to September 21, 2021.

The lender response:

When contacted Mrs. Ogochukwu Ekezie-Ekaidem, chief brand and marketing officer of Union Bank to the lender’s angle. She said: “To date, neither the bank nor any of the said officers (past or present) has been served any court processes relating to any such action.

“Further, the statements and assertions contained in the outline shared with us are factually inaccurate and patently false.

“Please, be reminded that proceeding to publish a report based on factual inaccuracies will be regarded as wilful libel against the parties named in the outline. We will therefore be constrained to seek legal redress in defence of the truth,” the statement read.

![]()