FXTM, a leading global online trading firm, has launched FXTM Edge, a mobile-first trading platform designed to make forex and commodity trading more accessible to Nigerian traders.

The platform, unveiled at a media roundtable in Lagos, aims to simplify trading by addressing common barriers such as high entry costs, technical complexity and lack of structured learning support.

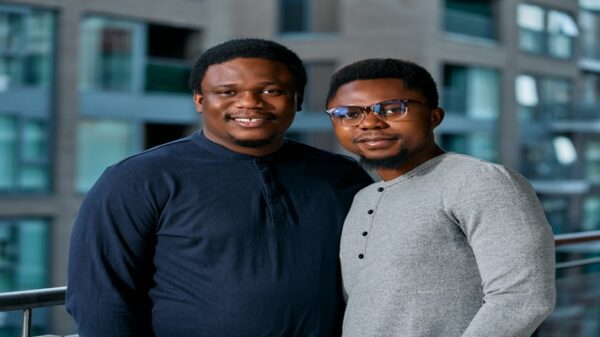

Adaeze Uzochukwu, Specialist, Education and Media at FXTM, said FXTM Edge was developed with the Nigerian market in mind, combining affordability, accessibility and education in one package.

“Many Nigerians are interested in trading but are held back by complexity, high costs or lack of experience,” she said. “FXTM Edge was built to remove those barriers and give everyone a chance to participate in global markets confidently.”

With a minimum deposit requirement of $50, compared to the previous $200, the platform lowers the entry threshold for Nigerians looking to trade. It also allows micro-lot trading, enabling users to start small and manage risk effectively

Uzochukwu said the platform offers a user-friendly interface, built-in educational resources and trade inspiration to help beginners build confidence step by step.

For experienced traders, FXTM Edge delivers competitive spreads starting from 1.2, a reward system that covers both lots and units traded, and the option to test strategies at lower cost.

She added that the mobile-first design reflects the growing reliance on smartphones for financial activities in Nigeria, offering speed, convenience and flexibility to traders on the move.

“Trading should not be intimidating. With Edge, beginners can start small, learn with the right support and gradually grow at their own pace,” she said.

Backed by FXTM’s global reputation for reliability and expertise, the new platform is expected to encourage broader participation of Nigerians in global financial markets.

![]()