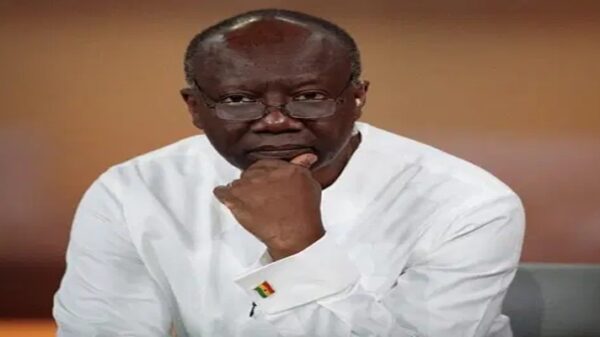

The Bank of Ghana (BoG) has suspended the remittance partnerships of several fintech companies including Flutterwave, Tap Tap Send, and others for a period of one month starting September 18, 2025. The suspension follows violations of the 2023 Updated Guidelines for Inward Remittance Services by Payment Service Providers.

In a statement released on September 4, 2025, the central bank named the affected Money Transfer Operators (MTOs) as Tap Tap Send, Top Connect, Remit Choice, Send App, and Afriex. It also suspended remittance partnerships with Payment Service Providers (PSPs) Flutterwave Inc., Cellulant Ghana, and Halges Financial Technologies, the latter facing an indefinite ban until fresh approval is obtained.

The Bank of Ghana’s action was prompted by breaches involving unauthorized remittance activities conducted with the PSPs through United Bank for Africa Ghana (UBA Ghana), their settlement bank. The regulator warned that these MTOs and PSPs could only resume remittance operations upon re-application and approval by the Bank after the suspension period.

The BoG emphasized strict adherence to foreign exchange market regulations and cautioned that non-compliance would attract further regulatory sanctions. The suspension is expected to impact the flow of inward remittances via the affected fintech firms, disrupting fund transfers to recipients within the country during this period.

This regulatory measure underscores the central bank’s commitment to enforcing compliance with remittance guidelines and safeguarding the integrity of Ghana’s foreign exchange market.

![]()