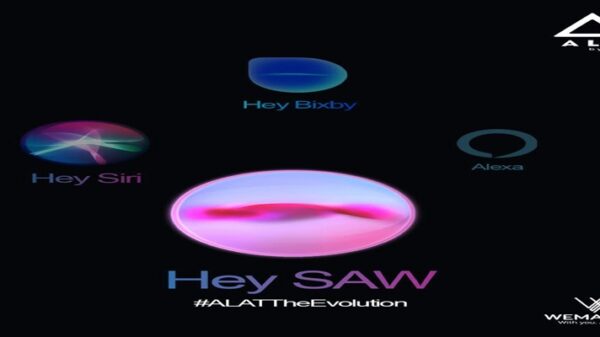

Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) have ordered Deposit Money Banks and Mobile Network Operators to settle the long-standing N250bn USSD debt dispute before January 2, 2025.

The CBN and NCC also directed banks to pay the pre-Application Programming Interfaces (API) debt before July 2, 2025.

They also ordered that post-API debts be settled before December 31, 2024.

Read Also: Naira Note Hawking: CBN Slaps Banks with N150 Million Fine – Ravenewsonline

The directive was issued in a joint cirular titled, “2nd Joint Circular of the Central Bank of Nigeria and the Nigerian Communications Commission on the Resolution of the USSD Debt Issue Between Deposit Money Banks and Mobile Network Operators.”

The circular dated December 20, 2024, was signed by Oladimeji Taiwo, acting director of the Payments System Management Department, CBN, and Chizua Whyte, head of Legal and Regulatory Services, NCC.

The regulators said, “In view of the foregoing, the CBN and the NCC hereby direct DMBs and MNOs as follows: 1. That 60 per cent of all pre-API invoices must be paid as full and final settlement.

“Payment plans (lump sum or installments) must be agreed upon between a concerned DMB and MNO by January 2, 2025. Installments must be based on equal monthly payments, with full payment due by July 2, 2025.

“DMBs must pay 85 per cent of all outstanding invoices issued after the implementation of APIs (i.e., February 2022) by December 31, 2024.

“Similarly, 85 per cent of future invoices must be liquidated within one month of service.”

According to the regulators, the transition to end-user billing will be activated only for DMBs and MNOs that comply with the payment conditions cobtained in the circular.

CBN and the NCC said they would provide further guidance on public enlightenment initiatives related to the transition.

The regulators also directed MNOs to implement the “10-seconds rule” for USSD invoicing.

Read Also: CBN Governor Issues Stern Warning to Banks Over Cash Scarcity – Ravenewsonline

This implies that any session lasting less than ten seconds will not be billable.

The regulators added, “Failure to comply with the terms outlined in this directive will attract necessary sanctions, ensuring that both DMBs and MNOs uphold their obligations.”

![]()