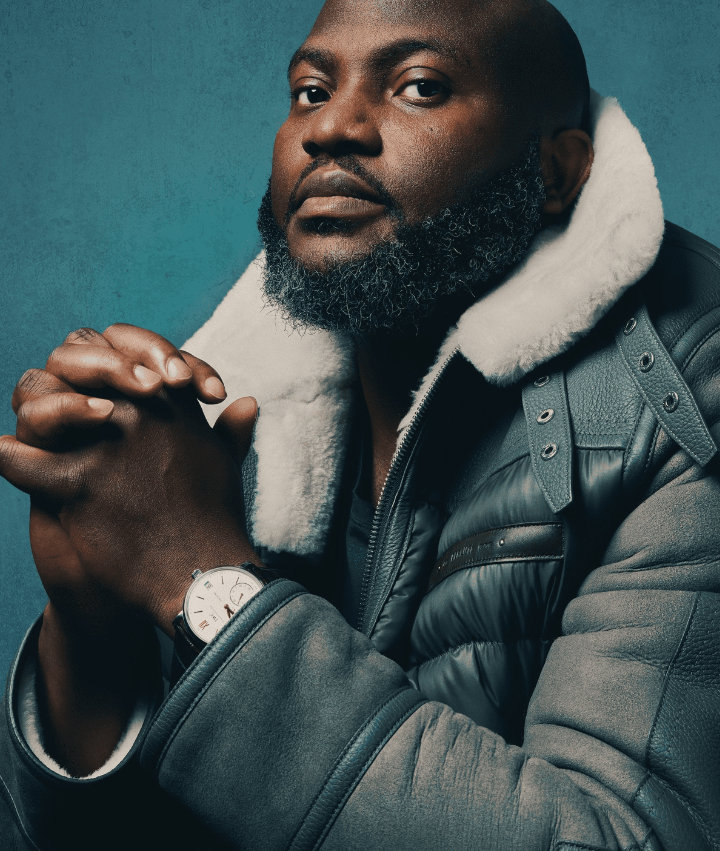

America’s Securities and Exchange Commission (SEC) will bring charges against Dozy Mmobuosi, the CEO of Tingo Group, for fabricating financial statements and other documents of three of Tingo Group and its subsidiaries, Tingo Mobile and Tingo Foods PLC.

Dozy Mmobuosi and all three of Tingo’s subsidiaries are listed as defendants in the case with charges ranging from insider trading, lying to auditors, and failing to disclose the sale of millions of common shares for which he was the ultimate beneficial owner and internal controls violations.

The announcement of the charges comes one month after the SEC formally launched an investigation into Tingo Group. The agency also suspended trading in the shares of the self-described agritech company.

Part of the SEC’s filing said, “Mmobuosi made and caused the entities to make material misrepresentations about their business operations and financial success in press releases, periodic SEC filings.”

One significant misrepresentation, for instance, is that while Tingo Group reported having cash and cash equivalent of $461.7 million for the fiscal year 2022, its bank accounts held less than $50 in total. The SEC also said Mmobuosi “fraudulently obtained hundreds of millions in money or property through these schemes, and that Mmobuosi has siphoned off funds for his personal benefit, including purchases of luxury cars and travel on private jets, as well as an unsuccessful attempt to acquire an English Football Club Premier League team, among other things.”

Tingo Group was the subject of an explosive report published by Hindenburg Group, the famous American short seller. The research firm called Tingo Group an “exceptionally obvious scam with completely fabricated financials” in June 2023.

![]()