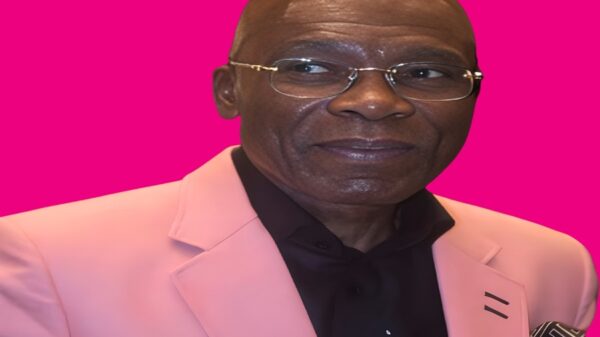

By Hussein Sayed, Chief Market Strategist at FXTM

The Federal Reserve is in no rush to end its ultra-accommodative monetary support. That’s the conclusion from the latest minutes of the Federal Open Market Committee’s Meeting in March, which means we didn’t learn anything new. Asset purchases of $120 billion per month and interest rate kept close to zero will stay for some time.

Over the past several months, many economists and market participants have been worried about a surge in inflation, but the Fed doesn’t seem to be. According to the minutes, several market participants see the factors that contributed to low inflation during the previous expansion could again exert more downward pressure on inflation than expected. This suggests that any rise in prices due to supply disruptions and pent-up demand would prove to be transitory and not sustained over the longer term. This should be good news for risk assets, especially those equities in the growth sector that have recently underperformed the broader market.

US Treasury markets seem to have steadied following the sharp selloff since the beginning of the year. Yields on the 10-year bond have fallen more than 10 basis points from the March peak. However, it’s still not clear whether this is due to abating inflation fears or the rebalancing of portfolios at the end of the last quarter. We will know the answer within the next two to three weeks.

So far, it seems we are in a goldilocks situation. Economic data over the past few days have been very encouraging, corporate earnings are expected to improve significantly when results are announced over the upcoming days, more stimulus is set to arrive in the form of infrastructure spending and President Biden has begun negotiations on raising corporate taxes to 28% from 21%.

Given this environment, expect US stocks to continue outperforming non-US stocks at least in the short term, equities to outperform bonds and if corporate earnings surprise to the upside, this would pave the way for more record highs.

The dollar has been under pressure over the past few days with the dollar index dropping from a five-month high of 93.44 to a two-week low of 92.14 yesterday. The fall in the greenback is mainly driven by the recent drop in yields but looking at where the US economy stands compared to the rest of the developed economies, there is still room to see the dollar considerably higher from current levels.

![]()